Crypto Traders in Americas Remain Steady Despite Thursday’s Slide

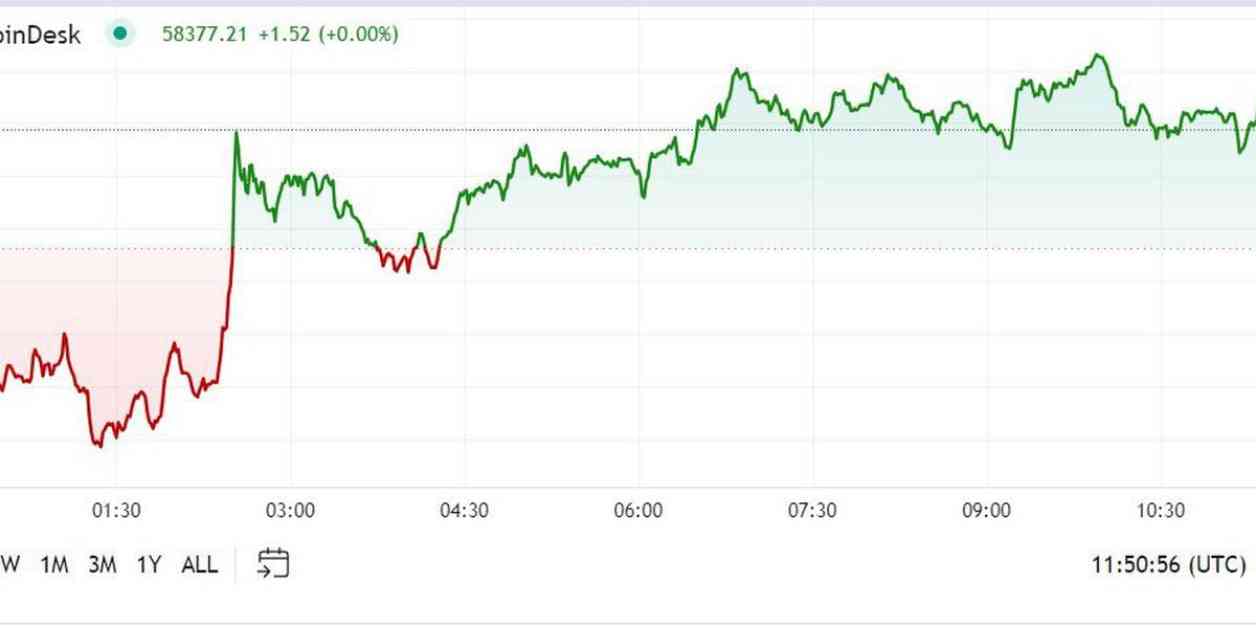

The cryptocurrency market in the Americas showed resilience after a slight dip on Thursday, with traders maintaining a steady approach to their investments. Bitcoin was down by 0.7% to $58,376, while Ether dropped by 1.0% to $2,614. Despite these minor fluctuations, the overall sentiment in the market remained relatively stable.

Market Analysis and Price Movements

During the Asian and European trading sessions, the crypto market experienced a period of calm as bitcoin hovered around $58,500, marking a 0.45% decrease over 24 hours. Ether also saw a decline of 0.7%, while Solana (SOL) emerged as a top performer with a gain of 0.44%. The CoinDesk 20 Index, which tracks the performance of various digital assets, was up by approximately 0.39%.

The dip in bitcoin prices on Thursday, dropping below $57,000, caught many traders by surprise as there was no clear catalyst for the sell-off. Interestingly, this occurred at a time when traditional markets such as the Nasdaq and S&P 500 were trending upwards, adding to the mystery surrounding the sudden price movement.

South Korea’s National Pension Service Invests in MicroStrategy

In a notable development, South Korea’s National Pension Service made a significant investment of nearly $34 million in MicroStrategy shares. Following the software company’s recent 10:1 stock split, the pension fund now holds 245,000 MSTR shares valued at $32.32 million based on Thursday’s closing price. This move can be interpreted as an indirect bet on bitcoin, as MicroStrategy is one of the largest corporate holders of the cryptocurrency.

Despite missing its revenue target for the second quarter, MicroStrategy received a bullish price target upgrade from Wall Street broker Benchmark, raising it to $2,150 from $1,875. This positive outlook reflects the confidence in MicroStrategy’s strategic approach to holding bitcoin as a long-term asset.

It’s worth noting that the National Pension Service also holds over $45 million worth of Coinbase shares, indicating a growing interest in digital assets among institutional investors in South Korea.

New York Stock Exchange Pulls Back on Bitcoin ETF Listing

In a surprising turn of events, the New York Stock Exchange decided to withdraw its plans to list bitcoin ETF options, as revealed in an SEC filing. The SEC had been reviewing the proposal for several months, extending the review period multiple times before initiating formal proceedings in April. However, the exchange opted to pull back its proposal before a final decision was reached.

Meanwhile, CBOE, a platform where several bitcoin ETFs are traded, also withdrew its application but later resubmitted a more comprehensive proposal, as reported by Bloomberg’s James Seyffart. The lack of public comment or feedback from the SEC on this matter has left investors and industry observers wondering about the regulatory outlook for bitcoin ETFs in the U.S.

Chart Analysis: U.S.-Listed Spot Bitcoin ETFs

A chart provided by Bloomberg and CoinShares offers insights into the recent flows and total assets under management (AUM) of U.S.-listed spot bitcoin ETFs. Notably, BlackRock’s iShares ETF has surpassed Grayscale’s Bitcoin Trust to become the largest in terms of AUM.

Grayscale’s GBTC, which had a head start over the newly launched ETFs in January, has experienced significant outflows to its competitors. This shift in investor preferences highlights the evolving dynamics within the bitcoin ETF market and the growing competition among providers.

Conclusion

In conclusion, the cryptocurrency market in the Americas has shown resilience in the face of recent price fluctuations, with traders maintaining a steady approach to their investments. Institutional interest in digital assets is on the rise, as evidenced by the National Pension Service’s strategic investments in companies like MicroStrategy and Coinbase.

The regulatory uncertainty surrounding bitcoin ETFs in the U.S. continues to be a point of concern for market participants, as evidenced by the recent withdrawal of listing plans by the New York Stock Exchange. Nevertheless, the overall sentiment remains cautiously optimistic, with market participants closely monitoring developments in the crypto space.

As the market continues to evolve and adapt to changing dynamics, investors are advised to stay informed and exercise caution when navigating the volatile landscape of cryptocurrencies.