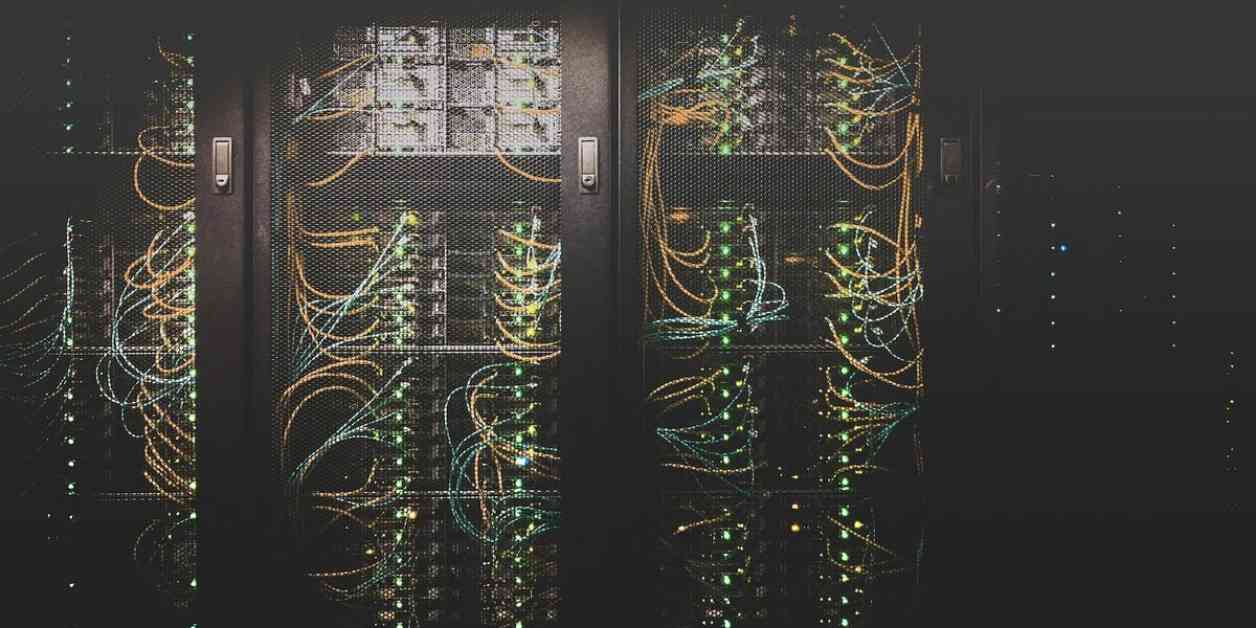

A private equity firm called Aurum Equity Partners announced on Tuesday that they are launching a $1 billion tokenized equity and debt fund on the XRP Ledger (XRP) network. This blockchain network is closely associated with Ripple, a well-known enterprise-focused blockchain platform. The fund will focus on investing in data centers located in the U.S, United Arab Emirates, Saudi Arabia, India, and Europe. According to the press release, this fund is claimed to be the “world’s first combined equity and debt tokenized fund.”

The technology behind this fund leverages the services of Zoniqx, a tokenization service provider based in San Francisco. Zoniqx will help create security tokens for the underlying financial instruments involved in the fund. This marks a significant milestone for the XRP Ledger and Ripple Labs, as they are venturing into the world of real-world asset (RWA) tokenization. This move aligns with the trend of institutional investors increasingly turning to blockchain technology to streamline traditional financial products like bonds, credit, and equity for more efficient operations and faster settlements, 24/7.

Reports from various sources like McKinsey, BCG, 21Shares, and Bernstein suggest that the RWA market could potentially grow to trillions of dollars in the coming years. Ripple is also awaiting approval from regulators in New York to launch a U.S. dollar stablecoin, which is expected to enhance liquidity and support institutions in tokenizing and settling financial assets on the XRPL network. At Ripple Labs’ annual Swell conference, President Monica Long emphasized the importance of this stablecoin in facilitating financial transactions on the network.

David Schwartz, Ripple’s chief technology officer and co-creator of the XRP Ledger, highlighted that tokenizing private equity is an emerging use case in the world of RWA. This approach aims to address the challenges of illiquidity and limited market access in traditional private equity markets. By utilizing the XRPL’s efficient and secure transaction processing capabilities, Aurum and Zoniqx are demonstrating how real-world assets can be managed more effectively using decentralized blockchain technology.

In addition to their efforts in the tokenization space, Ripple continues to make strides towards innovation and regulatory compliance. The company’s upcoming stablecoin and partnerships like the one with Aurum Equity Partners showcase their commitment to transforming the financial industry through blockchain technology. As the world of digital assets and tokenization evolves, collaborations between traditional financial institutions and blockchain companies are likely to become more common, shaping the future of finance.