Gemini, a popular cryptocurrency exchange, has recently launched its services in France, allowing users in the country to deposit, trade, and store digital assets. This move comes just ahead of the implementation of the European Union’s Markets in Crypto Assets (MiCA) regulations, which will enable registered companies to expand their operations across the trading bloc.

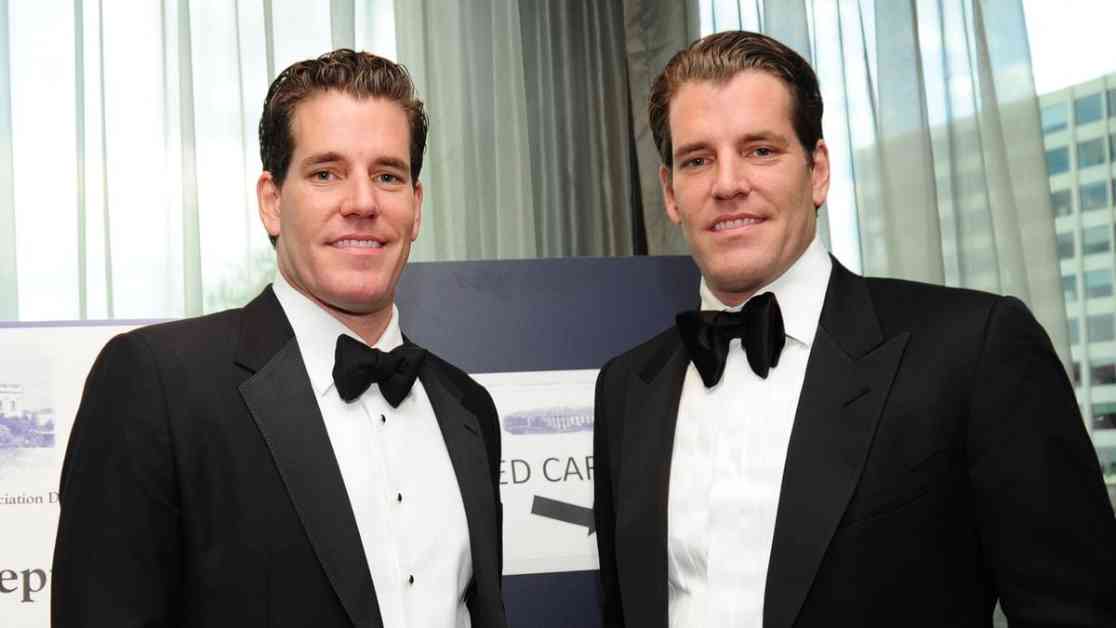

This development opens up new opportunities for users, including institutions, in France, the EU’s second-largest economy. Users can now create Gemini accounts and fund them using debit cards and bank transfers. The company, founded by Cameron and Tyler Winklevoss, aims to capitalize on the growing interest in digital assets in France and establish a strong presence in the European market.

Gemini’s decision to enter the French market is strategically timed, as the MiCA regulations are set to come into full effect by the end of the year. These regulations will allow companies with MiCA approval in one EU country to operate in other member states as well. In the meantime, companies registered in an EU member country can operate in their home country for a specified period, giving them time to secure approval for cross-border operations.

Gillian Lynch, Gemini’s CEO of U.K. and Europe, highlighted the company’s commitment to expanding its presence in Europe. The company’s affiliate, Gemini Intergalactic Europe, has already obtained digital asset service provider registration in France and is also registered with the central bank of Ireland. This positions Gemini well to capitalize on the growing demand for digital asset services in Europe.

Overall, Gemini’s entry into the French market represents a significant milestone for the company and underscores its commitment to expanding its global footprint. With the implementation of the MiCA regulations on the horizon, Gemini is well-positioned to navigate the evolving regulatory landscape in Europe and establish itself as a leading player in the digital asset space.