Bitcoin’s value has plummeted below $100,000 for the third consecutive day, marking a significant downturn in the cryptocurrency market. This drop comes in response to escalating trade tensions between the United States and its neighboring countries, particularly Canada. Prime Minister Justin Trudeau of Canada announced retaliatory import tariffs against the U.S., following President Donald Trump’s imposition of tariffs on Canadian and Mexican imports, as well as goods from China. This move has sparked fears of a renewed trade war and potential inflationary pressures.

Trudeau’s decision to impose 25% tariffs on a range of U.S. goods, from beverages to household appliances, has further heightened concerns about the economic implications of these escalating trade disputes. In response, China has indicated its intention to challenge the U.S. at the World Trade Organization, with promises of countermeasures to protect its own interests. The combination of trade tensions and mass deportations of illegal migrants from the U.S. has created a volatile economic environment, casting doubts on the possibility of swift Federal Reserve rate cuts.

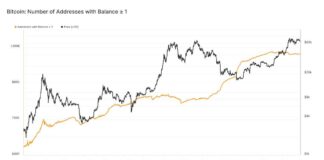

The impact of these geopolitical developments is clearly reflected in the cryptocurrency market, with Bitcoin experiencing a notable decline in value. As the leading cryptocurrency by market capitalization and the only major asset available for trading during the weekend, Bitcoin’s price weakness is seen as a response to the prevailing uncertainties in the global economy. This downward trend in Bitcoin’s value is not only indicative of market sentiment but also serves as a risk-off signal for traditional risky assets.

Expert Insights from Omkar Godbole

Omkar Godbole, a Co-Managing Editor on CoinDesk’s Markets team based in Mumbai, offers valuable insights into the current state of the cryptocurrency market. With a background in finance and a Chartered Market Technician (CMT) member, Godbole brings a wealth of experience and expertise to the discussion. Having previously worked in research on currency markets and as a fundamental analyst at brokerage houses in Mumbai, Godbole’s perspective sheds light on the broader implications of Bitcoin’s price movements.

Godbole’s analysis suggests that the recent decline in Bitcoin’s value is a reflection of the prevailing economic uncertainties stemming from the trade tensions between the U.S., Canada, and China. As these geopolitical dynamics play out on the global stage, the cryptocurrency market reacts to the perceived risks and uncertainties associated with these developments. The broader crypto market has also followed Bitcoin’s lead, with the CoinDesk 20 Index experiencing a significant decline of over 2%.

In conclusion, the convergence of trade disputes, geopolitical tensions, and economic uncertainties has created a challenging environment for both traditional and digital assets. Bitcoin’s price drop below $100,000 underscores the impact of these factors on the cryptocurrency market, highlighting the interconnected nature of global financial markets. As investors navigate this volatile landscape, the insights provided by experts like Omkar Godbole offer valuable perspectives on the complex dynamics at play.