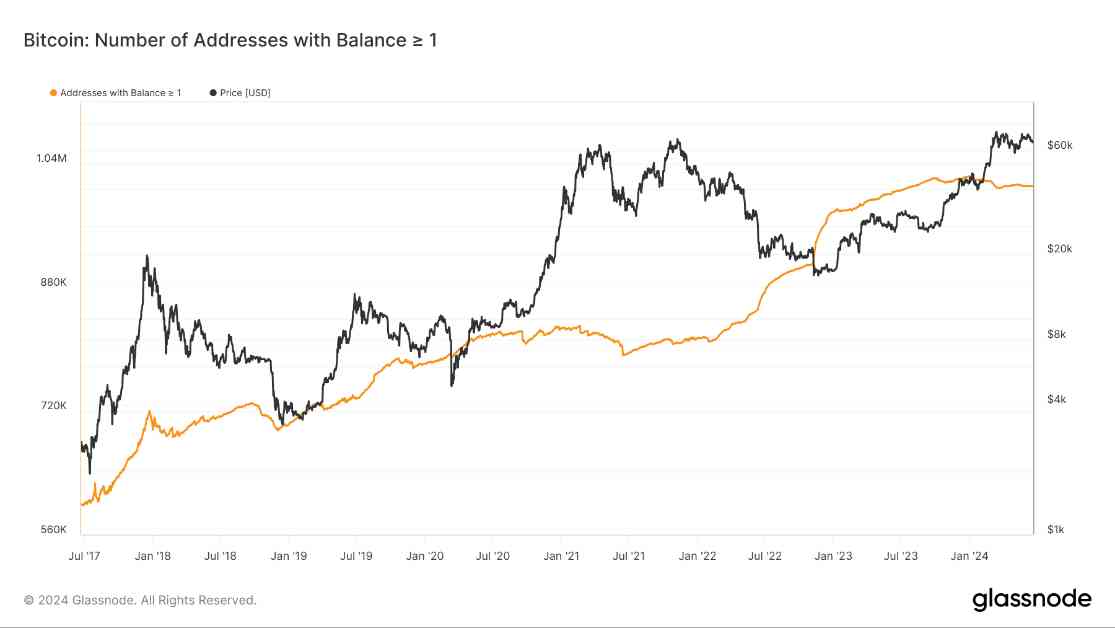

Bitcoin addresses holding more than 1 BTC have decreased slightly, now totaling just above 1 million. This trend is significant as it showcases Bitcoin’s resilience in the face of price fluctuations.

At the beginning of 2024, there were approximately 1.023 million addresses with at least 1 BTC. However, this number dropped to around 1.011 million by mid-June. Interestingly, this decline coincided with a period of relative stability in Bitcoin’s price, which was hovering around $60,000.

When we look at the data from mid-2017 to mid-2024, we can see a consistent increase in the number of addresses holding more than 1 BTC. This figure has risen from about 600,000 to over 1 million, indicating a growing accumulation among holders despite the volatility in Bitcoin’s price.

The continuous growth in the number of addresses with at least one Bitcoin demonstrates a sustained interest and confidence in the cryptocurrency, even during times of market uncertainty. This trend also highlights the increasing decentralization and distribution of Bitcoin holdings among individual investors, which could potentially contribute to the digital asset’s long-term stability.

In conclusion, while there has been a slight decrease in the number of Bitcoin addresses holding more than 1 BTC, the overall trend of increasing accumulation and decentralization bodes well for the resilience and stability of the cryptocurrency in the long run. Investors and enthusiasts continue to show strong interest and confidence in Bitcoin, further solidifying its position in the world of digital assets.