Swiss National Bank President Dismisses Bitcoin as Reserve Asset

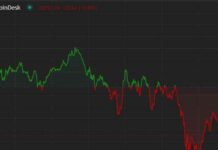

In a recent interview with the Tamedia group, Swiss National Bank (SNB) President Martin Schlegel made headlines by dismissing the idea of including bitcoin in Switzerland’s central bank reserves. This decision was based on concerns regarding the stability, liquidity, and security of cryptocurrencies, which Schlegel believes make them unsuitable for such a purpose.

Schlegel highlighted three main issues with cryptocurrencies that led to his decision. Firstly, he pointed out the high volatility of these digital assets, which he believes makes them unreliable for long-term value preservation. Secondly, he emphasized the importance of liquidity in reserves, stating that assets need to be readily available for monetary policy purposes. Lastly, Schlegel raised concerns about the security risks associated with software-based assets, noting the potential vulnerabilities and weaknesses in such systems.

This stance from the Swiss National Bank President comes at a time when Switzerland is experiencing a growing interest in cryptocurrencies, with various Swiss banks offering services related to digital assets. Despite this trend, Schlegel referred to cryptocurrencies as a “niche phenomenon,” downplaying their significance in the broader financial landscape. He expressed confidence in the Swiss franc’s continued strength and stated that the bank is not worried about competition from digital currencies.

Initiative for Bitcoin Reserves Faces Uphill Battle

A recent initiative led by entrepreneur Yves Bennaim has sparked debate in Switzerland by advocating for a constitutional amendment that would require the SNB to hold bitcoin in its reserves alongside gold. The initiative, launched in December, aims to collect 100,000 signatures within 18 months to trigger a nationwide vote on the proposal.

While the initiative does not provide specific details on how bitcoin allocations would be implemented, it suggests that the funds should be accumulated from the bank’s earnings. This move represents a bold push towards integrating cryptocurrencies into the country’s financial infrastructure, challenging traditional views on reserve assets.

Expert Insights on the Future of Cryptocurrencies in Switzerland

Francisco Rodrigues, a reporter for CoinDesk specializing in cryptocurrencies and personal finance, shared his perspective on the evolving landscape of digital assets in Switzerland. With a background in major financial and crypto publications, Rodrigues brings a wealth of knowledge to the discussion.

Rodrigues highlighted the significance of Switzerland’s increasing acceptance of cryptocurrencies, noting the expanding range of services offered by Swiss banks to cater to customer demand for digital assets. While Schlegel’s dismissal of bitcoin as a reserve asset reflects a cautious approach from traditional financial institutions, Rodrigues emphasized the potential for cryptocurrencies to disrupt the existing financial system and create new opportunities for investors.

As the debate over the role of cryptocurrencies in Switzerland continues to unfold, it is clear that divergent views exist regarding the future of digital assets in the country’s financial landscape. While some, like Schlegel, remain skeptical of the suitability of cryptocurrencies as reserve assets, others, such as proponents of the initiative led by Bennaim, are pushing for greater integration of digital assets into the mainstream financial system.

In conclusion, the decision by the Swiss National Bank to dismiss bitcoin as a reserve asset underscores the complex challenges and opportunities presented by the rise of cryptocurrencies. As Switzerland navigates this rapidly evolving landscape, the debate over the role of digital assets in the country’s financial future is likely to intensify, shaping the direction of financial innovation in the years to come.