The Evolution of Financial Technology

Financial technology, commonly known as FinTech, has revolutionized the way we manage and interact with our finances. From mobile banking apps to peer-to-peer payment systems, FinTech has made financial services more accessible, efficient, and user-friendly. The rapid advancement of technology has led to the development of sophisticated financial tools and platforms that cater to a wide range of needs, from personal budgeting to complex investment strategies.

One of the key drivers of FinTech innovation is the increasing demand for seamless and secure financial transactions. Consumers and businesses alike seek solutions that provide convenience without compromising security. This has led to the integration of advanced technologies such as artificial intelligence (AI), blockchain, and biometrics into financial systems. These technologies not only enhance the user experience but also provide robust security measures to protect sensitive financial data.

In countries like Bangladesh, the FinTech sector is experiencing significant growth, with numerous startups and established financial institutions offering innovative solutions. For those seeking comprehensive financial planning services, it is essential to choose providers that leverage the latest technology to ensure security and efficiency. For instance, services like best financial planning services in Bangladesh are increasingly adopting FinTech solutions to offer tailored financial advice and investment strategies.

The Role of Cybersecurity in FinTech

As FinTech continues to evolve, the importance of cybersecurity cannot be overstated. Financial transactions involve sensitive information, making them prime targets for cybercriminals. The integration of cybersecurity measures is crucial to protect both the financial institutions and their clients from potential threats. Cybersecurity in FinTech encompasses a wide range of practices and technologies designed to safeguard financial data and ensure the integrity of transactions.

One of the primary cybersecurity challenges in FinTech is the prevention of data breaches. Financial institutions must implement robust security protocols to protect customer data from unauthorized access. This includes the use of encryption, multi-factor authentication, and regular security audits. Additionally, the adoption of AI-driven security systems can help detect and mitigate potential threats in real-time, providing an added layer of protection.

Another critical aspect of cybersecurity in FinTech is compliance with regulatory standards. Financial institutions must adhere to strict regulations to ensure the security and privacy of customer data. Compliance with standards such as the Payment Card Industry Data Security Standard (PCI DSS) and the General Data Protection Regulation (GDPR) is essential for maintaining trust and credibility in the financial sector.

Emerging Technologies in FinTech Cybersecurity

The rapid advancement of technology has led to the development of innovative cybersecurity solutions for the FinTech industry. AI and machine learning are at the forefront of these advancements, providing advanced threat detection and response capabilities. AI-driven systems can analyze vast amounts of data to identify patterns and anomalies that may indicate a potential security breach. This proactive approach enables financial institutions to take preventive measures before a breach occurs.

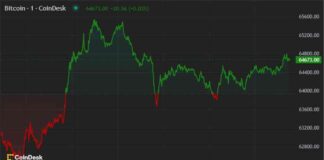

Blockchain technology is another emerging innovation in FinTech cybersecurity. Blockchain’s decentralized nature and cryptographic security make it an ideal solution for secure financial transactions. By leveraging blockchain, financial institutions can ensure the integrity and transparency of transactions, reducing the risk of fraud and tampering. Additionally, blockchain-based smart contracts can automate and enforce contractual agreements, further enhancing security and efficiency.

Biometric authentication is also gaining traction in the FinTech sector as a means of enhancing security. Biometric identifiers such as fingerprints, facial recognition, and voice recognition provide a more secure and convenient alternative to traditional password-based authentication. By integrating biometric authentication into financial platforms, institutions can significantly reduce the risk of unauthorized access and identity theft.

The Future of FinTech and Cybersecurity

The future of FinTech and cybersecurity is poised for significant advancements, driven by the continuous evolution of technology. As financial institutions strive to meet the growing demands of consumers and businesses, the integration of advanced technologies will play a crucial role in shaping the future of the industry. The adoption of AI, blockchain, and biometric authentication will continue to enhance the security and efficiency of financial transactions, providing a seamless and secure user experience.

Moreover, the collaboration between financial institutions and technology companies will be essential in driving innovation and addressing the challenges of cybersecurity. By leveraging the expertise of technology partners, financial institutions can develop and implement cutting-edge solutions that meet the evolving needs of the market. This collaborative approach will not only enhance the security of financial transactions but also foster a culture of innovation and continuous improvement.

In conclusion, the intersection of FinTech and cybersecurity is a dynamic and rapidly evolving field. The integration of advanced technologies such as AI, blockchain, and biometric authentication is crucial for ensuring the security and efficiency of financial transactions. As the industry continues to evolve, the adoption of these technologies will play a pivotal role in shaping the future of FinTech and cybersecurity. By embracing innovation and collaboration, financial institutions can provide secure and user-friendly financial services that meet the needs of consumers and businesses alike.