The cryptocurrency market showed little reaction to the highly anticipated HBO documentary that claimed to reveal the true identity of Satoshi Nakamoto, the mysterious creator of Bitcoin. Despite the documentary naming Bitcoin developer Peter Todd as Nakamoto, Todd had already denied these claims prior to the broadcast. While unveiling Satoshi’s true identity could potentially impact market volatility, HBO’s attempt, like previous ones, failed to provide concrete evidence.

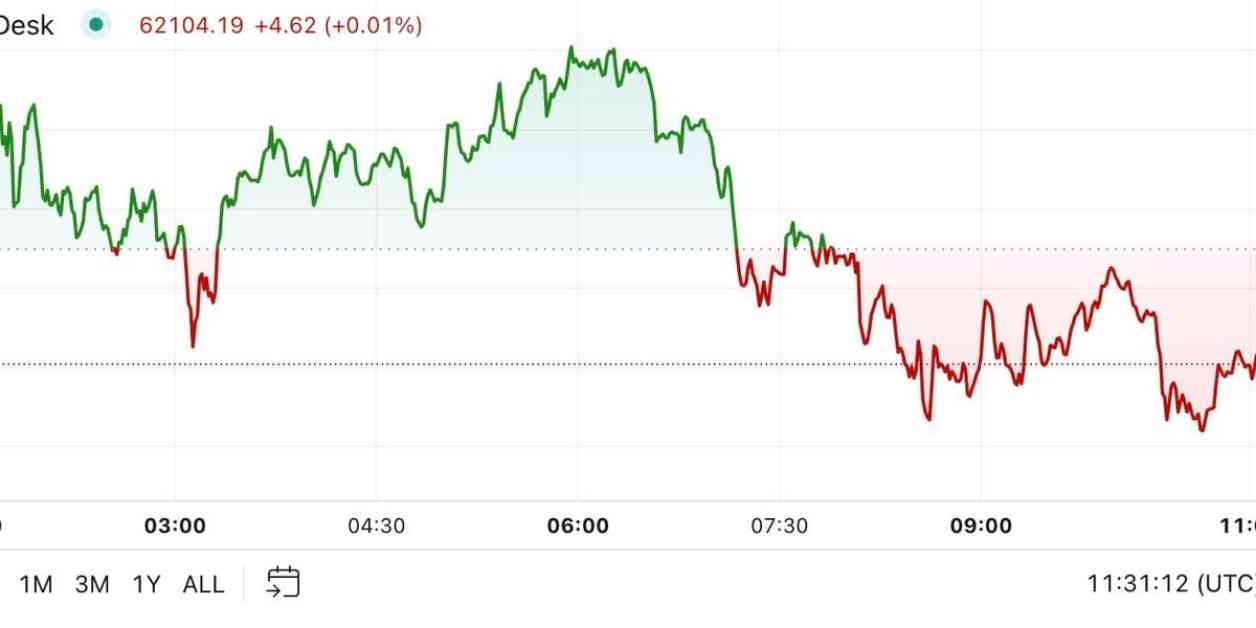

As a result, Bitcoin’s price remained relatively stable at around $62,150, experiencing a slight decrease of about 0.45% over the last 24 hours. The broader digital asset market, as indicated by the CoinDesk 20 Index, also showed minimal changes. In the U.S., spot Bitcoin exchange-traded funds (ETFs) saw a combined outflow of over $18 million, while Ether ETFs recorded withdrawals exceeding $8 million.

The recent low volatility in Bitcoin followed a lack of new stimulus measures announced at a Chinese briefing, dampening hopes for an extended stimulus package that had previously fueled a Bitcoin rally. Concurrently, Chinese stocks experienced significant declines, with the Shanghai Composite Index dropping by 3.9% and Shenzhen’s Component Index falling by 4%. Market participants are now awaiting updates from the September Federal Reserve meeting to gauge Bitcoin’s future movements.

A substantial Bitcoin options trade suggests a potential shift from the current low-volatility environment to a period of increased price fluctuations, possibly surpassing the $53,000-$87,000 range. The trade involved the purchase of 100 contracts of $66,000 strike call and put options expiring on November 29, with a net premium of over $1 million. This strategy, known as a long straddle, is profitable if Bitcoin’s price moves significantly above $87,000 or below $53,000 by the end of November.

In other news, data from the U.S. Office of Financial Research, as shared by Apollo’s Chief Economist Torsten Sløk, highlights a concerning trend in outstanding loans provided by prime brokerages to hedge funds. The total amount has surpassed $2 trillion, raising potential risks to financial stability.

It is important to note that CoinDesk, the source of this analysis, is a reputable media outlet that upholds strict editorial policies to ensure integrity, independence, and unbiased reporting. CoinDesk is part of the Bullish group, which supports various digital asset businesses. Journalists at CoinDesk may receive equity-based compensation from the Bullish group.