Bitcoin, the largest cryptocurrency by market cap, has seen a significant surge of 12% this week, hinting at a potential new all-time high in the near future. However, this journey to new highs may face obstacles due to profit-taking in the market.

Historical data suggests that over 94% of the circulating supply of Bitcoin is currently sitting in profit. When the percentage of supply in profit crosses the 94% threshold, it often leads to selling pressure from profitable holders looking to capitalize on their gains. This could result in price corrections as these holders start liquidating their coins in a rising market.

Long-term holders (LTH), who have been holding their coins for at least 155 days, are likely to be the ones taking profits. Glassnode data shows that LTHs currently hold only 500,000 BTC at a loss, compared to their total holdings of 14 million BTC. On the other hand, short-term holders own 235,000 BTC at a loss, the lowest since March during Bitcoin’s previous all-time high.

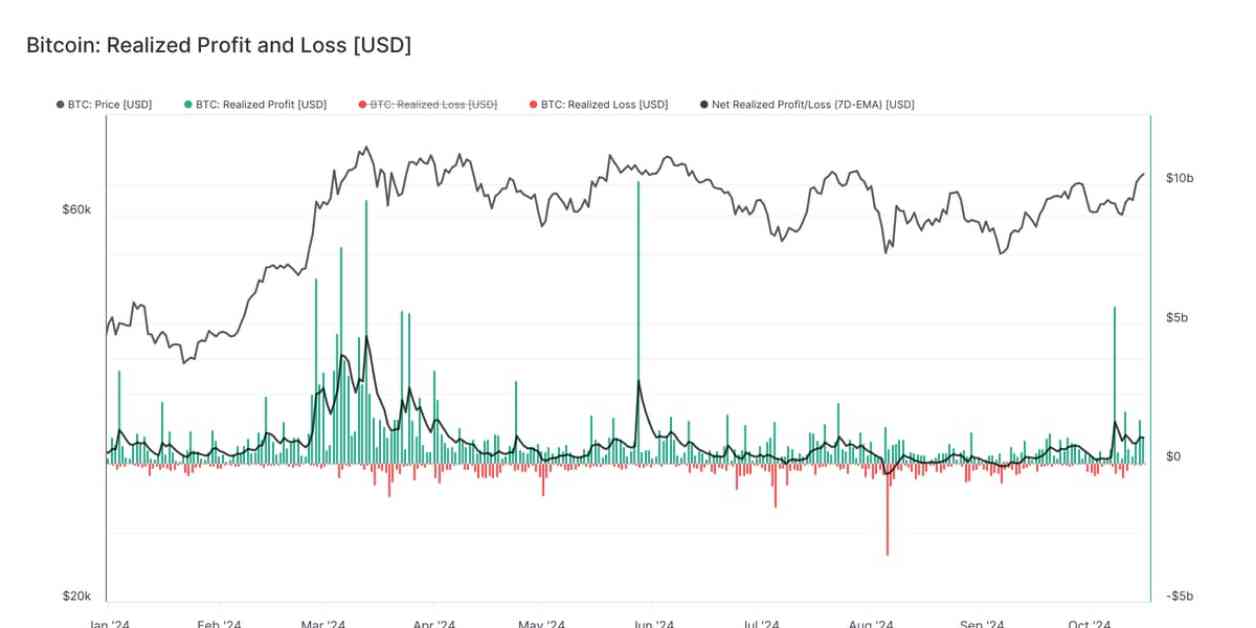

Profit-taking has already begun, with over $11 billion in realized profit recorded in just over a week. On October 8 alone, $5.6 billion in profit was taken, marking the single biggest profit-taking day since May 28. This indicates that some investors are already cashing out on their gains.

Despite the potential impact of profit-taking, Bitcoin’s rally shows strong momentum. Bitcoin dominance is approaching 60%, reaching levels last seen in April 2021. Additionally, Bitcoin has remained resilient even as the DXY index, which measures the dollar against a basket of other currencies, continues to climb higher. The last time the DXY index was above 103 was back in August during the yen carry trade unwind, which caused Bitcoin to drop from $65,000 to $49,000.

Overall, while the path to new all-time highs for Bitcoin may face challenges due to profit-taking, the underlying strength of the rally and the market dynamics suggest that Bitcoin’s journey is far from over. Investors should keep a close eye on market trends and indicators to navigate the volatile cryptocurrency landscape successfully.