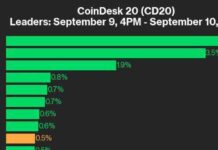

Cryptocurrencies experienced a significant decline today, following the downward trend in the traditional stock market. The CoinDesk 20 index, which tracks the top 20 cryptocurrencies based on market capitalization, excluding stablecoins and exchange coins, dropped by 2.6% in the last 24 hours. Chainlink (LINK) was the worst performer, plummeting by 7.6%. However, Internet Computer (ICP) managed to rise by 1% despite the overall market downturn.

Bitcoin (BTC) saw a 2.3% decrease, trading at $66,000, while ether (ETH) experienced a more substantial drop of 5.3%, falling below $2,490. On the other hand, Solana (SOL) remained relatively stable at $169. The ETH/BTC ratio hit a low not seen since April 2021, dropping below 0.038. Additionally, the SOL/ETH trading pair reached a new all-time high, rising by 6.3% to 0.068. This sparked discussions within the crypto community regarding Ethereum’s roadmap and performance compared to other cryptocurrencies.

Despite the upcoming U.S. election, which could potentially impact the market, uncertainties loom over the crypto space. The broader stock market, including the S&P 500, Nasdaq, and Dow Jones, all declined by more than 1% as investors awaited the election outcome. The bond market also saw a decrease, with the 10-year Treasury yield reaching a three-month high of 4.25%. Gold prices slipped by 1.1% to $2,730 per ounce, while oil prices fell by 1.35% to $70.77 per barrel.

In the midst of this market pullback, crypto equities were not spared. Bitcoin mining companies like MARA Holdings (MARA) and CleanSpark (CLSK) faced a decline of around 5%. Coinbase (COIN) and MicroStrategy (MSTR) also experienced losses of 6% and 2.5%, respectively.

Looking ahead, analysts are keeping a close eye on Tesla’s quarterly earnings report, which could potentially influence market dynamics. Despite the current uncertainties, some experts remain optimistic about the future, with expectations of positive developments in November.

As the crypto market continues to navigate through challenges, it is essential for investors to stay informed and monitor the evolving landscape. Adapting to market fluctuations and understanding the underlying factors driving these changes will be crucial for making informed investment decisions in the volatile cryptocurrency space.