Bitcoin’s recent surge in price, reaching over $69,000, has been largely attributed to the rise in leverage trading. Leverage trading involves using borrowed funds to increase potential returns on investments, allowing traders to control larger positions than their capital alone would allow.

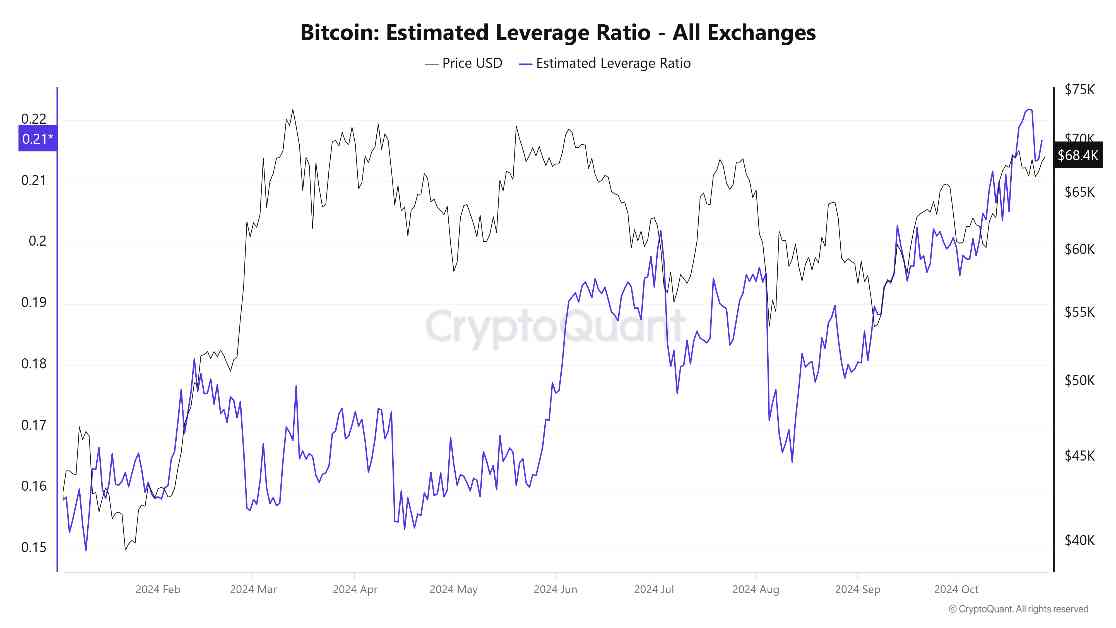

Data from CryptoQuant shows that the Estimated Leverage Ratio hit a yearly high of 0.22 on October 24, before slightly declining to 0.21 on October 26. This ratio compares the open interest in futures contracts to the balance of the corresponding exchange.

Last week, Bitcoin’s open interest exceeded $40 billion for the first time, setting a new record in the crypto derivatives market. Although it dipped to around $37 billion over the weekend, it has since rebounded by 6% in the last 24 hours to $40.08 billion as of press time, according to CoinGlass data. This rebound contributed to Bitcoin’s price briefly climbing to as high as $69,225 earlier today.

While leverage trading can amplify profits, it also comes with significant risks. It can lead to substantial losses and increased market volatility. This raises concerns about the sustainability of Bitcoin’s recent price surge.

Investors and traders are now engaging in discussions about the potential risks and rewards of leverage trading in the cryptocurrency market. It is important for individuals to carefully consider their risk tolerance and investment strategies when participating in leveraged trading to avoid significant financial losses.

As Bitcoin continues to attract attention from institutional investors and retail traders alike, the use of leverage trading is likely to remain a prominent feature in the cryptocurrency market. However, it is essential for market participants to exercise caution and prudence when utilizing leverage to maximize potential gains while minimizing risks.