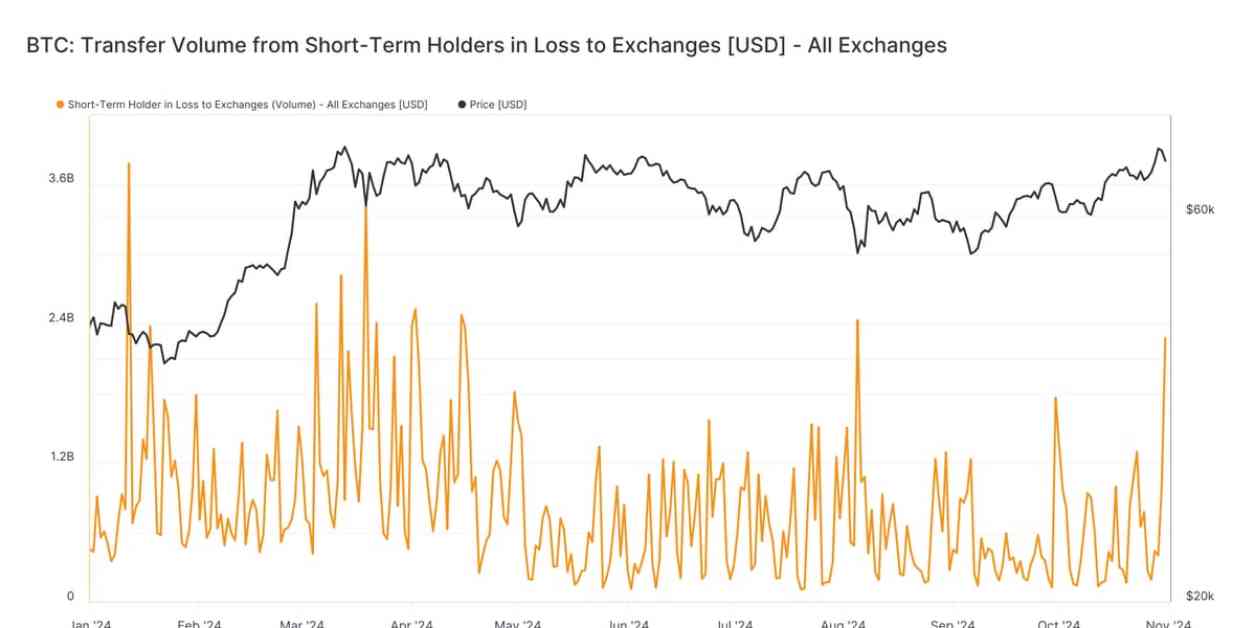

Short-term holders of bitcoin (BTC) made a significant move on Thursday by sending over $2 billion worth of bitcoin to exchanges at a loss. This panic selling came as the price of bitcoin dropped below $70,000 after reaching near all-time highs earlier in the week. This action by short-term holders, who have held bitcoin for less than 155 days, is the most significant since the yen carry trade unwind on Aug. 5.

The recent days have seen short-term holders sending over $6 billion worth of bitcoin to exchanges at a profit, locking in their gains as the month came to a close. This behavior is typical of short-term holders, who tend to panic sell when the price drops and buy when there is euphoria in the market.

Several factors may have contributed to the recent drop in bitcoin’s price, including the upcoming U.S. presidential election on Nov. 5. Investors are likely reducing their exposure to risk as the election approaches, a common practice on the last day of the month. Additionally, the U.S. stock market experienced a significant decline on Thursday, with tech stocks leading the losses.

Breaking down the 54,000 bitcoin sent to exchanges on Thursday, research has shown that a significant portion was sent in profit as bitcoin approached its record high from March. Over the past three days, more than $6 billion worth of bitcoin was sent to exchanges in profit, indicating that investors were capitalizing on the recent price increase. Despite the 6% drop in price, long-term holders who bought bitcoin when it was above $70,000 in May and July have remained unfazed by the recent fluctuations.

Due to the uncertainty surrounding the U.S. election, it is unlikely that bitcoin will reach new all-time highs until after the results are known. Investors are cautious and may be waiting for a clearer picture before making significant moves in the market. It will be interesting to see how the price of bitcoin reacts in the coming days as the election draws near.

As an award-winning media outlet covering the cryptocurrency industry, CoinDesk is committed to upholding strict editorial policies to ensure integrity, independence, and freedom from bias in its publications. CoinDesk is part of the Bullish group, which invests in digital asset businesses, and employees may receive equity-based compensation from Bullish. Senior analyst James specializes in Bitcoin and the macro environment, bringing valuable insights to readers.