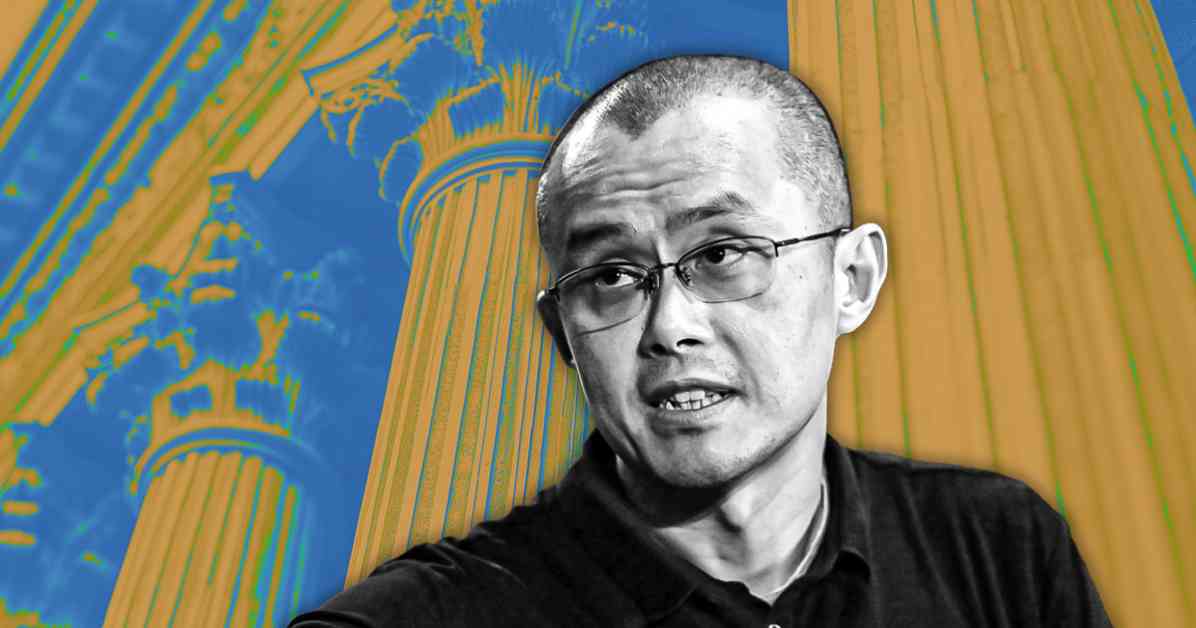

Binance and its founder, Changpeng Zhao, are pushing back against the US Securities and Exchange Commission’s (SEC) lawsuit regarding the classification of cryptocurrencies. In a recent court filing on November 4, Binance argued that the SEC failed to consider a previous court ruling that established cryptocurrencies are not automatically classified as securities.

The legal team representing Binance and Zhao emphasized that the SEC’s amended complaint goes against the court ruling that differentiated cryptocurrencies from securities. They pointed out that the SEC’s stance ignores the implications of the ruling, which indicated that resales of digital assets on secondary markets do not qualify as securities transactions once the assets are initially distributed by developers.

Furthermore, the defendants disputed the legal basis of the SEC’s amended complaint in distinguishing between assets involved in investment contracts and the investment contracts themselves. They highlighted that assets, whether physical like oranges or digital like crypto assets, do not remain investment contracts indefinitely simply because they were initially offered as part of a package that met the criteria of an investment contract under the Howey test.

Binance also clarified that transactions involving token sales on exchanges are typically impersonal, with matching software executing trades without direct interaction between buyers and sellers. This lack of direct involvement leads to buyers not having a reasonable expectation of investing in a joint enterprise for profit, thus failing to meet the requirements of an investment contract under securities law.

The motion to dismiss filed by Binance includes a challenge to the SEC’s characterization of blind sales of BNB by Binance Holdings Limited (BHL) as investment contracts. Binance and Zhao argued that these sales are more akin to resales, with buyers having limited information about the seller, making them unlikely to meet the criteria for investment contracts.

Additionally, Binance is seeking to reject the SEC’s requests for disgorgement and to bar Zhao from participating in the securities market. The filing pointed out the lack of allegations in the amended complaint that demonstrate any harm caused to customers by the actions of BHL or Mr. Zhao, which is necessary for the SEC to pursue disgorgement.

The SEC’s decision to expand its lawsuit against Binance earlier this year to cover more digital assets, along with its assertion that most crypto transactions qualify as securities transactions, has sparked debate in the industry. Critics have raised concerns about the SEC’s inconsistent approach to defining the security status of digital assets and potential contradictions with court rulings.

Overall, Binance’s legal challenge against the SEC’s lawsuit underscores the ongoing regulatory uncertainties surrounding cryptocurrencies and the need for clarity in defining their legal status in the securities market.