Cryptocurrency Market Update: Bitcoin Price Drops 1.8% as Ether Price Surges 5.6%

The cryptocurrency market saw some ups and downs recently, with Bitcoin prices dropping by 1.8% while Ether prices surged by 5.6%. This shift in prices has caught the attention of investors and traders alike, as they try to navigate the volatile market.

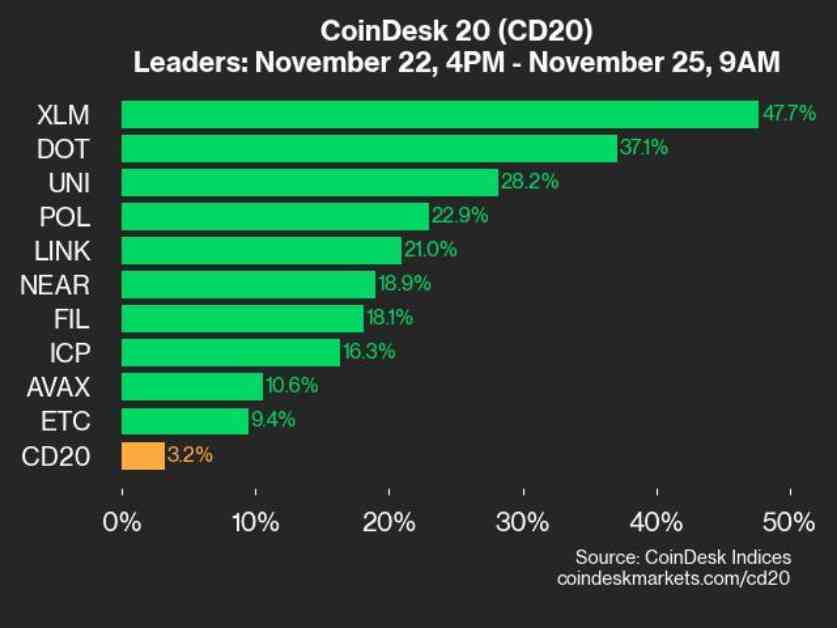

The CoinDesk 20 Performance Update showed some interesting trends, with XLM experiencing a significant surge of 47.7% and Polkadot also joining as a top performer with a gain of 37.1%. These numbers indicate the potential for growth and profitability in the cryptocurrency market, despite the fluctuations in prices.

As of November 25, 2024, the CoinDesk 20 Index was trading at 3382.04, showing a 3.2% increase since the previous day. This positive movement was reflected in the performance of 17 out of the 20 assets, which were trading higher.

Tracy Stephens, the Senior Index Manager at CoinDesk Indices, shared insights into the market update. With her background in traditional finance and experience in building systematic trading strategies, Tracy brings a wealth of knowledge to the world of cryptocurrency. Her expertise in data science and quantitative research adds a layer of credibility to the analysis of market trends and fluctuations.

The CoinDesk 20 Index is a broad-based index that is traded on multiple platforms across various regions globally. This diversity in trading platforms and regions allows for a more comprehensive view of the cryptocurrency market, providing insights into the performance of different assets and their potential for growth.

While some assets like SOL and BTC experienced a slight decline in prices, the overall trend in the market seems to be positive. The surge in XLM and Polkadot indicates a growing interest in these cryptocurrencies, as investors look for opportunities to capitalize on the market movements.

As the cryptocurrency market continues to evolve and attract more attention from investors, it is essential to stay informed about the latest trends and developments. Keeping an eye on the performance of different assets, understanding the factors that influence price movements, and seeking expert analysis can help navigate the volatile market and make informed investment decisions.