The cryptocurrency market is expected to experience increased volatility at the end of this week, as the monthly options contracts for Bitcoin (BTC) and Ethereum (ETH) are set to expire on Friday. This timing comes right after the U.S. Thanksgiving holiday, providing traders with the potential for a volatile market post-holiday. The total value of BTC and ETH options contracts that will expire on the Deribit trading exchange is $9.4 billion and $1.3 billion respectively, happening at 08:00 UTC on November 29th.

Options give the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price within a certain timeframe. Data from Deribit shows that out of the $9.4 billion notional value in Bitcoin options set to expire, over $4.2 billion (45%) are considered “in-the-money” (ITM). The majority of these ITM options are calls, with almost 80% of them being so. Calls that are ITM have a strike price below the current market price, while ITM puts have strike prices above the spot price.

The high number of call options that are ITM could lead to increased volatility as the options expiry approaches, as investors may look to close their positions and realize significant profits. Last month’s expiry on October 25th saw a 3% drop in Bitcoin’s price as over $4 billion worth of options expired.

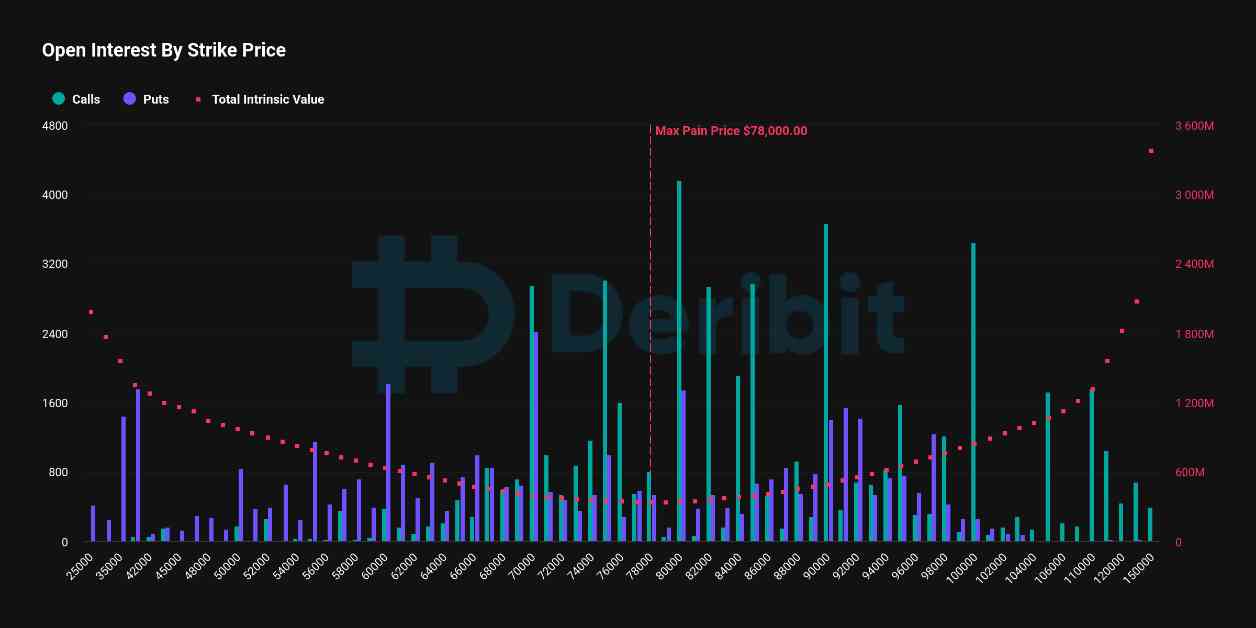

Andre Dragosch, European head of research at Bitwise, notes that most of the open interest in put options is concentrated around the $70,000 strike price, but considers this outcome to be unlikely. He sees the majority of open interest for calls centered around the $82,000 and $70,000 strike prices. While the max pain theory suggests a move towards the $70,000 – $82,000 range, Dragosch believes that temporary consolidation is more probable due to high sentiment and profit-taking.

Looking at the out of the money (OTM) options, puts dominate the landscape significantly. Out of the $5.2 billion total notional value that is OTM, over $4.1 billion (98%) are in OTM puts. These could be used by traders to hedge against downside risk or make bearish bets that may not come to fruition, resulting in unrealized losses.

Dragosch argues that the concentration in puts is likely due to hedging rather than bearish bets. The put-call open interest ratio remains high, indicating a focus on puts for hedging purposes rather than outright downside speculation. With Bitcoin’s price well above the max pain price of $78,000, many call options are deep in the money. This large gap between the current spot price and the max pain price could force market makers to hedge by purchasing Bitcoin, potentially leading to a further rally that could push the price towards $100,000.