Ethereum, a popular blockchain platform, has seen a significant increase in the usage of a new data management tool called “blobs.” These blobs were introduced earlier this year as part of the Dencun upgrade, allowing users to attach large data chunks to transactions without clogging up the main Ethereum network. This has led to faster and more affordable transactions for Ethereum users, as blobs store data off-chain.

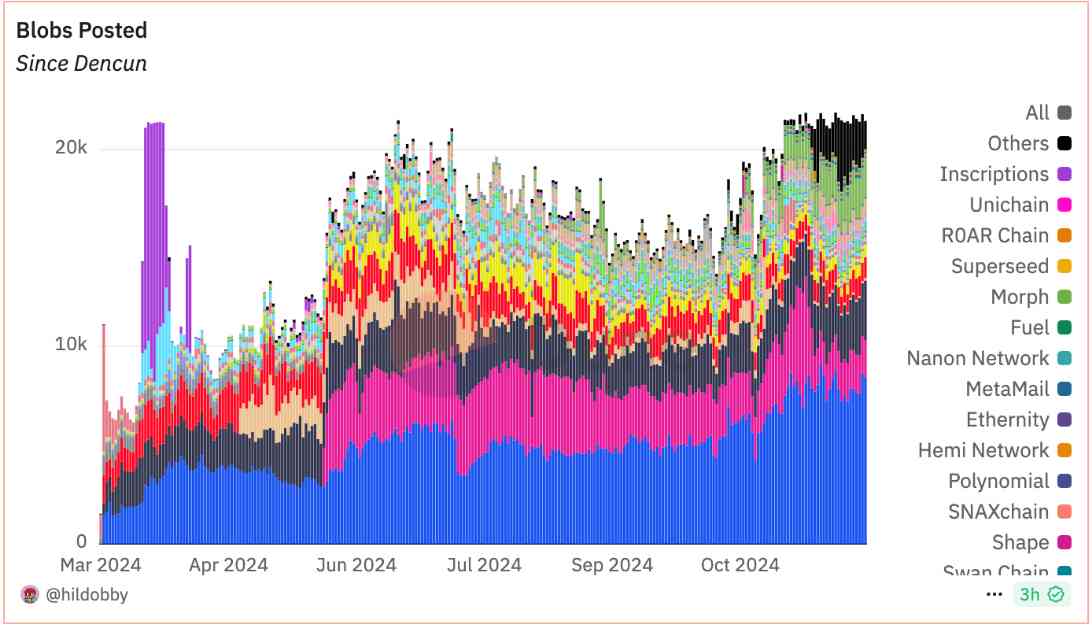

The number of blobs posted on Ethereum has been steadily increasing, with over 21,000 blobs posted this month alone. This surge in blob usage indicates that more users are adopting layer-2 scaling solutions, such as BASE, Arbitrum, and Optimism, which use blobs to bundle transactions together and process them off-chain before posting them to the Ethereum main chain for verification.

Matthew Siegel, head of digital assets research at VanEck, noted that transactions on Ethereum and its layer 2 solutions have reached all-time highs, with a 40% increase compared to the summer. Additionally, the average blob count has increased by about 20%, leading to higher blob fees on layer 2 solutions.

Blobs are posted on Ethereum by layer 2s in a dedicated area called Blobspace within Ethereum’s blocks. However, posting blobs comes with a cost, as users need to pay blob fees in Ethereum’s native token, ether. These fees are burned, similar to transaction fees, which reduces the circulating supply of ether in the market.

Recently, blob fees have spiked, reaching as high as $80, the highest since March. On average, there are 4.3 blobs posted in each Ethereum block, and over the past seven days, blob fees have burned more than 166 ETH, equivalent to $560,000. This increased demand for blobspace on layer 1 has led to a discovery of the blob fee market, suggesting potential outperformance for ether in the future.

Despite the rise in blob fees, Ethereum’s price has been performing well, reaching a four-month high of $3,546 on Monday. This outperformed bitcoin, which experienced a 5% drop during the same period. However, Ethereum’s price has since pulled back to $3,370, according to CoinDesk data.

Overall, the surge in blob usage on Ethereum indicates a growing interest in layer-2 scaling solutions and the potential for further growth in the cryptocurrency market. As users continue to adopt these solutions, we may see increased efficiency and affordability in Ethereum transactions in the future.