In the latest update on the cryptocurrency market, major tokens like Bitcoin and Ether saw significant declines during Asian trading hours on Tuesday. This drop was influenced by profit-taking and outflows from U.S.-listed Bitcoin ETFs, which impacted bullish sentiment.

Bitcoin slid to nearly $66,500, reversing all gains from Monday, while Ether fell to $3,400, erasing last week’s progress. The 50-day moving average at $66,000 has been a key level to watch for Bitcoin, testing the medium-term uptrend. Additionally, BTC ETFs saw net outflows of $145 million, continuing a trend from the previous week.

Notable losses were seen in tokens like Dogecoin (DOGE) and Solana’s SOL, which dropped as much as 9% in the past 24 hours, according to CoinGecko data. Other tokens like Ton Network’s TON and BNB Chain’s BNB also experienced losses, with the CoinDesk 20 (CD20) index down 4.2%.

Factors such as political uncertainty in France, with President Emmanuel Macron calling for a snap election, have contributed to a stronger dollar and put downward pressure on Bitcoin. Analysts suggest that lower interest rates and a weaker dollar would be needed to push BTC closer to the $70,000 mark.

While there were some optimistic developments around Ether ETFs, the overall sentiment remains bearish. Ethereum briefly dipped under its 50-day moving average on Friday but managed to add over 6% following positive ETF news. However, a 1.5% loss at the start of Monday raises concerns about the near-term performance of altcoins.

FxPro senior market analyst Alex Kuptsikevich warned of increased selling interest during weekdays, potentially favoring bears over bulls. The liquidity in the market could play a role in driving prices down further.

It’s important to note that CoinDesk, the source of this information, is a well-respected media outlet covering the cryptocurrency industry. They maintain strict editorial policies and operate independently despite being acquired by the Bullish group in 2023. The team at CoinDesk includes journalists like Shaurya, Deputy Managing Editor for the Data & Tokens team, who focus on decentralized finance, markets, and blockchain governance.

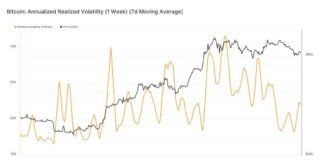

Overall, the recent cryptocurrency market update highlights the volatility and sensitivity of digital assets to various external factors. Investors and traders will need to closely monitor developments in the coming days to navigate these turbulent market conditions.