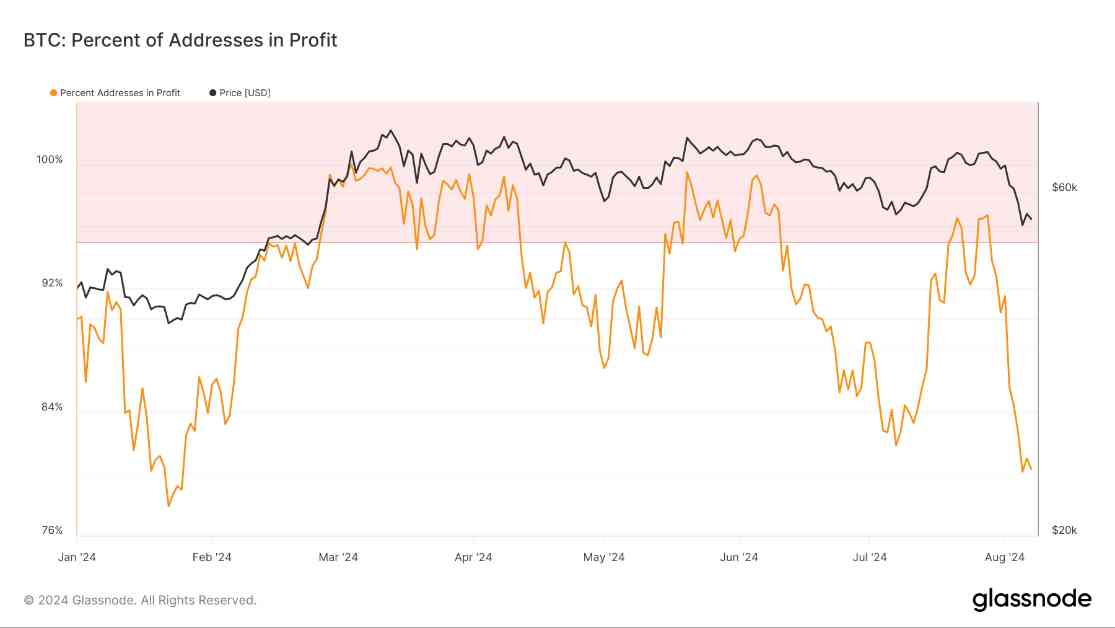

Bitcoin’s profitability has been a hot topic of discussion recently, especially with the upcoming halving event. According to recent data, the percentage of Bitcoin addresses in profit hit 100% before the halving but fell to 80% by August, showing significant fluctuations in profitability throughout the year.

This trend is not new to the cryptocurrency market, as similar patterns have been observed in previous cycles between 2018 and 2023. During the early months of 2024, the metric hovered around 92% as Bitcoin’s price reached around $50,000. However, leading up to the April halving, both the price and profit percentages saw increased volatility.

In March, the metric peaked at 100% when Bitcoin prices surged past $70,000, marking a significant high point for the year. But as the months went by, the percentage of addresses in profit dropped to around 80% by August, as Bitcoin’s price retraced below $55,000. These fluctuations reflect the cyclical nature of Bitcoin’s market behavior, influenced by major events like halvings and shifts in market sentiment.

It is important to note that these changes can have considerable impacts on the profitability of Bitcoin holders over time. As we look ahead to the future, it will be interesting to see how these trends continue to evolve and how they will affect the overall landscape of the cryptocurrency market.

In conclusion, Bitcoin’s profitability before and after the halving event has shown significant fluctuations throughout the year. These fluctuations highlight the cyclical nature of the market and the impacts of major events on the profitability of Bitcoin holders. As investors navigate through these changes, staying informed and adapting to market dynamics will be crucial for long-term success in the cryptocurrency space.