Investor confidence seems to be on the rise as bitcoin continues to hold above $100,000 and basis trade yields approach a whopping 9%. This has caught the attention of strong institutional interest, with U.S.-listed spot bitcoin exchange-traded funds (ETFs) recording $667.4 million in net inflows on May 19. This marks the largest single-day total since May 2, indicating a renewed interest from institutional investors. The iShares Bitcoin Trust (IBIT) saw a significant portion of these inflows, with $306 million pouring in and bringing the total net inflows to $45.9 billion, according to data from Farside Investors.

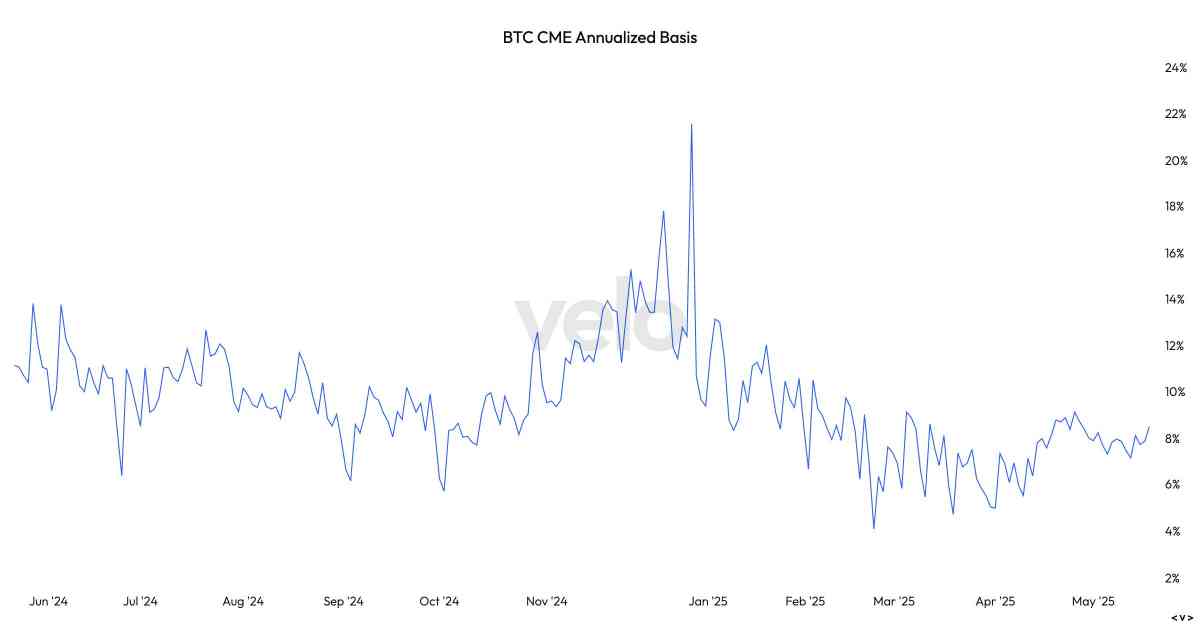

Bitcoin’s impressive price performance, trading above $100,000 for 11 consecutive days, has played a crucial role in restoring market confidence. Additionally, the annualized basis trade strategy, where investors go long on the spot ETF and simultaneously short bitcoin futures contracts on the CME, has become increasingly attractive with yields nearing 9%. This is almost double the figures observed in April, making it a lucrative option for investors. The surge in basis trade activity is evident in the trading volumes of CME futures, which hit $8.4 billion on Monday, the highest since April 23. Open interest also increased to 158,000 BTC, up over 30,000 BTC contracts from April, indicating a growing appetite for leveraged and arbitrage strategies.

Despite the recent growth, both futures volume and open interest are still below the levels seen when bitcoin reached an all-time high of $109,000 in January. This suggests that there is ample room for further growth in the market. The upswing in the basis trade indicates that this growth may already be underway, attracting back players who had exited the market earlier in the year when the basis dropped below 5%. Recent 13F filings revealed that the Wisconsin State Pension Board had exited its ETF position in response to a less favorable basis trade environment. However, with the basis spread widening from 5% to nearly 10%, it is plausible that the board reentered the market in the second quarter to capitalize on the improved arbitrage opportunity.

James Van Straten, a Senior Analyst at CoinDesk, specializing in Bitcoin and its interaction with the macroeconomic environment, provides valuable insights into the market dynamics. His expertise in on-chain analytics and monitoring flows helps analyze Bitcoin’s role within the broader financial system. In addition to his professional role, James also serves as an advisor to Coinsilium, a UK publicly traded company, guiding them on their Bitcoin treasury strategy. With investments in Bitcoin, MicroStrategy (MSTR), and Semler Scientific (SMLR), James brings a wealth of knowledge and experience to the table, shaping the future of the cryptocurrency market.