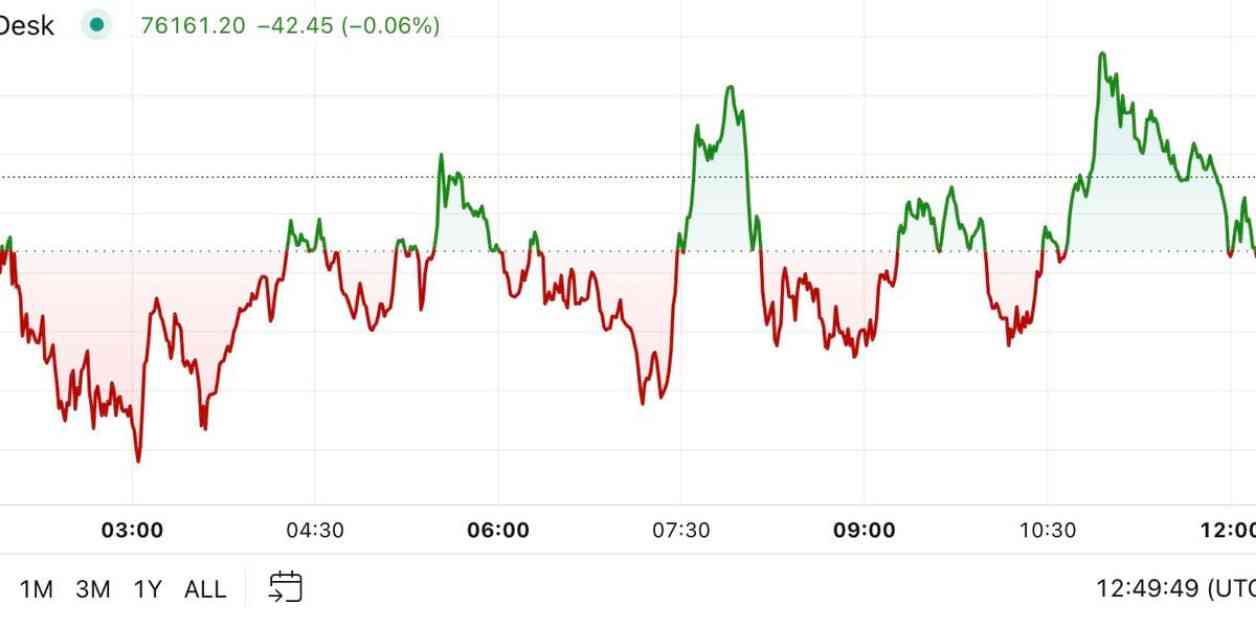

Bitcoin’s price continues to climb, with attempts to break above $76,000 in the Asian and European markets. Currently, BTC is up by 1.7% in the last 24 hours, sitting just below its all-time high of over $76,900. The overall digital asset market has seen a 4% increase, largely driven by significant gains from Cardano (ADA), up 16% at $0.43. Solana’s native token also experienced a surge, surpassing $200 for the first time since March and trading at around $204, marking an 8.75% increase in the last day.

Traders are now setting their sights on the $100,000 mark for Bitcoin, although analysts suggest a period of consolidation may precede this milestone. The recent surge in BTC’s price is attributed to President-elect Trump’s victory and the expected 25 basis-point interest rate cut by the Fed. However, concerns linger regarding possible setbacks due to Trump’s proposed tariffs on China and mounting fiscal issues such as increasing national debt. Despite these challenges, Alex Kuptsikevich, a senior market analyst at FxPro, remains optimistic about Bitcoin’s potential growth, predicting a rise to $100-110K within the next 2-3 months.

In the U.S., Bitcoin ETFs saw a record $1.38 billion in net inflows on the day of Trump’s election win. BlackRock’s IBIT led the way with over $1.1 billion in net inflows, marking the highest influx since its launch in January. This surge pushed total net inflows across all products past $25 billion for the first time, with no ETFs reporting any outflows. Ether ETFs also experienced renewed interest, attracting $78 million in net inflows following Trump’s victory and the optimism surrounding pro-crypto policies and deregulation.

Chart of the Day:

The SOL/BTC ratio is showing signs of a potential breakout, with SOL gaining 11% against Bitcoin in the past week. The breakout from a triangular consolidation pattern indicates bullish momentum, suggesting a move towards 2021 highs. Confirmation of this breakout will depend on the weekly candle closing above the upper trendline by Sunday (UTC).

In conclusion, the cryptocurrency market, led by Bitcoin, is experiencing significant growth and investor interest in the wake of recent political developments. Despite potential challenges ahead, the optimism surrounding digital assets remains strong, with key players like BlackRock showing confidence in the sector’s future. As Bitcoin continues its upward trajectory, all eyes are on the next major price levels and the potential for further market expansion in the coming months.