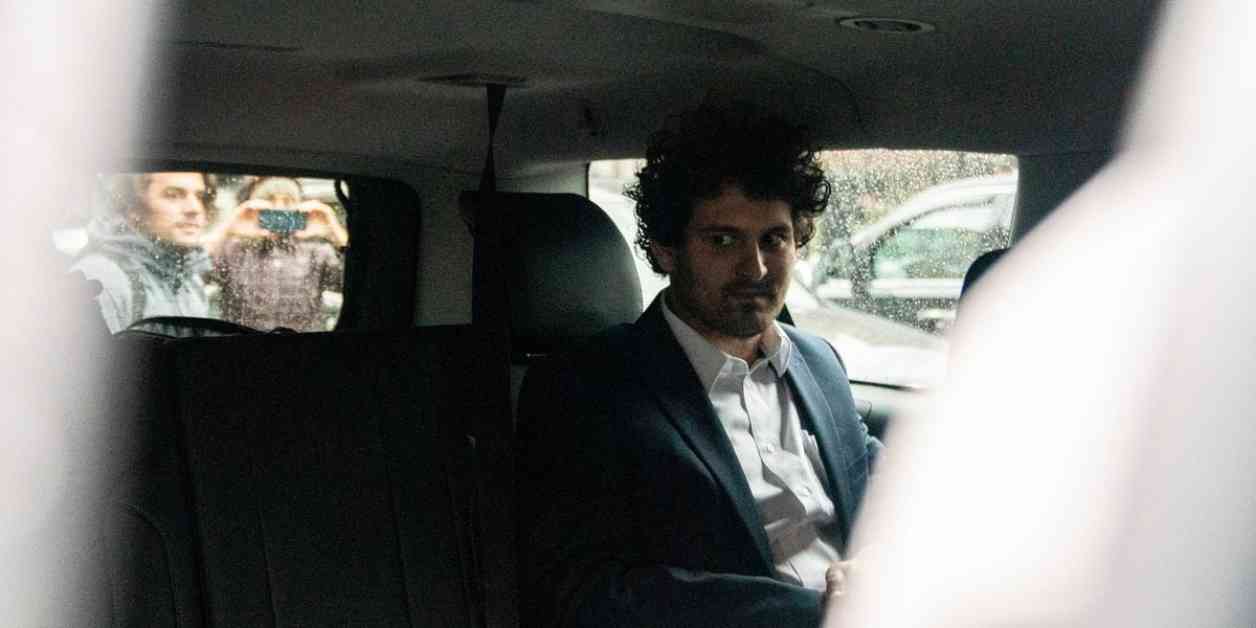

Sam Bankman-Fried, the former FTX founder, has been in the spotlight for the past 10 months following his conviction on seven counts of fraud and conspiracy related to the collapse of FTX. The aftermath of his sentencing to 25 years in federal prison in March has left the crypto industry reeling. However, with the recent appeal filed by his new legal team, led by Alexandra Shapiro, questions arise about the potential success of SBF’s appeal in court.

Challenging the Narrative

Shapiro’s appeal to the Second Circuit Court of Appeals challenges the narrative that has surrounded SBF since the beginning of his trial. She argues that he was unfairly treated, with federal prosecutors and the judge presuming his guilt without proper evidence or inquiry. The prevailing narrative of FTX’s collapse, and SBF’s involvement in it, was accepted as truth without allowing SBF to present his side of the story. The appeal aims to shed light on the fact that FTX was never truly insolvent and had assets worth billions to repay its customers, a fact that was overlooked during the trial.

Strategic Timing

The timing of SBF’s appeal, following the sentencing memorandum of Caroline Ellison, his former colleague and lover, raises questions about the strategic approach of his legal team. Ellison’s counsel has requested a non-custodial sentence, noting that the SBF case would have been difficult to prove without her testimony. By juxtaposing SBF’s harsh sentencing with Ellison’s potential light penalty, Shapiro may be aiming to highlight inconsistencies in the legal proceedings. Additionally, news of FTX creditors being repaid could potentially bolster SBF’s case, as it demonstrates that customers did not incur significant losses as initially believed.

Legal Challenges

Despite the arguments presented in SBF’s appeal, legal experts remain skeptical about the likelihood of a retrial. Tama Beth Kudman, a partner at Kudman Trachten Aloe Posner, notes the high bar for overturning a conviction and the reluctance of appellate courts to second-guess the decisions made in the original trial. To succeed in the appeal, SBF’s legal team would need to prove bias on the part of Judge Lewis A. Kaplan, which is a challenging task given his reputation as a fair and impartial judge. Without substantial evidence of misconduct or conflict of interest, the chances of a retrial remain slim.

Joshua Ashley Klayman, the U.S. head of fintech at Linklaters, suggests that the appeal may have been strategically timed to leverage recent developments in the case. By highlighting the disparity in sentencing between SBF and Ellison, Shapiro may be attempting to shift the narrative surrounding SBF’s culpability. However, the success of this strategy remains uncertain, as the legal grounds for overturning SBF’s conviction are still under scrutiny.

Implications for the Industry

The outcome of SBF’s appeal could have far-reaching implications for the crypto industry as a whole. The case has drawn widespread attention to issues of fraud and misconduct in the industry, leading to increased scrutiny from regulators and law enforcement agencies. A successful appeal by SBF could potentially undermine the credibility of such investigations and trials, casting doubt on the validity of convictions in similar cases. On the other hand, a reaffirmation of his conviction could serve as a warning to other industry players, highlighting the consequences of engaging in fraudulent activities.

In conclusion, the appeal filed by SBF’s new legal team represents a pivotal moment in his ongoing legal battle. The arguments presented in the appeal challenge the narrative that has surrounded his case and raise questions about the fairness of the original trial. While the outcome of the appeal remains uncertain, its implications for the crypto industry are significant. As the case continues to unfold, stakeholders in the industry will be closely watching to see how the legal proceedings shape the future of crypto regulation and enforcement.