Ethereum ETFs are set to launch next week, according to a Bloomberg analyst. The Securities and Exchange Commission (SEC) is expected to approve spot Ethereum exchange-traded funds with trading expected to start on July 23. The news has sparked excitement in the crypto community, with industry sources confirming the potential green light for these financial products.

Bloomberg senior ETF analyst Eric Balchunas reported on July 15 that the SEC is likely to request effectiveness after the close of business on July 22, paving the way for a Tuesday launch of the Ethereum ETFs. However, he noted that unforeseen issues could still arise before the launch.

This development comes after recent communications between the SEC and ETF issuers, indicating progress towards the approval of spot Ethereum ETFs. ETF Store President Nate Geraci also expressed confidence in the approval of these products, calling this week the likely approval period for spot Ethereum ETFs.

The introduction of spot ETH ETFs is seen as a major milestone for the crypto industry, providing investors with a regulated way to gain exposure to Ethereum. Market observers anticipate significant investment flows and the potential introduction of more cryptocurrency-based financial products following the launch, including those based on Solana and other digital assets.

Balchunas believes that this marks the beginning of crypto ETFs, with other tokens expected to follow in the footsteps of Bitcoin and Ethereum. He mentioned that Solana could be the next token to have its own ETF, signaling a trend that may continue in the future.

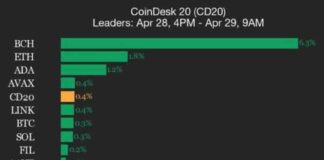

At the time of writing, Ethereum was trading at $3418 and was up 5.23% over the last 24 hours. The overall crypto market was valued at $2.37 trillion with a 24-hour volume of $84.72 billion, and Bitcoin dominance stood at 53.80%. These numbers indicate a positive trend in the cryptocurrency market, with potential for further growth and development in the coming days.

Overall, the approval of Ethereum ETFs is expected to bring more mainstream attention to the crypto industry and open up new opportunities for investors looking to diversify their portfolios. With the SEC’s anticipated green light, the launch of these financial products could mark a significant moment in the history of cryptocurrency investments.