Gold-backed cryptocurrencies have taken a hit as the price of gold experienced a significant drop, sparking speculation about Trump’s tariff tactics. Despite this, experts on Wall Street are urging investors to consider this dip as a buying opportunity in the world of digital assets.

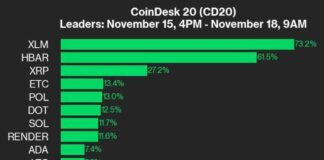

In recent weeks, the price of gold has seen a decline, contrasting with the rise of risk assets in the market. Cryptocurrencies backed by gold, such as Paxos Gold (PAXG) and Tether Gold (XAUT), have experienced a 1% decrease, trading around $2,900. This drop coincided with a surge in the broader crypto market, with the CoinDesk 20 Index climbing by 5.7% and the MarketVector Digital Assets 100 Index (MVDA) rising by 3.4%.

The speculation surrounding President Donald Trump’s proposed reciprocal tariffs has been a key factor in the fluctuation of gold prices. The announcement of potential tariffs has sparked uncertainty in the market, impacting safe-haven assets like gold and the U.S. dollar. While these tariffs may take time to implement, the market is buzzing with discussions about their potential impact on global trade.

Despite the uncertainty, experts at Morgan Stanley believe that the recent dip in gold prices could be seen as an opportunity for those seeking to hedge their investments against global reflation, geopolitical tensions, and increased fiscal spending. This sentiment is echoed by Wall Street giants who have revised their forecasts for the price of gold, indicating a potential rise in the value of gold-backed digital assets.

Citi strategists have raised their short-term gold price target to $3,000, with an average forecast for the year set at $2,900. Additionally, UBS has increased its 12-month gold target to $3,000 per ounce. These revised forecasts suggest a positive outlook for gold-backed tokens in the near future, as they are supported by physical gold stored in secure vaults.

According to Francisco Rodrigues, a reporter for CoinDesk with a keen interest in cryptocurrencies and personal finance, the current market conditions present a unique opportunity for investors to capitalize on the fluctuations in gold prices. Rodrigues, who holds investments in bitcoin, ether, solana, and PAXG, emphasizes the importance of staying informed and making strategic decisions in the ever-evolving world of digital assets.

As the market continues to react to geopolitical events and economic uncertainties, the role of gold-backed tokens in a diversified investment portfolio is gaining prominence. With expert insights pointing towards a potential rise in the value of these digital assets, investors are advised to carefully consider their options and stay informed about market trends to make informed decisions that align with their financial goals.