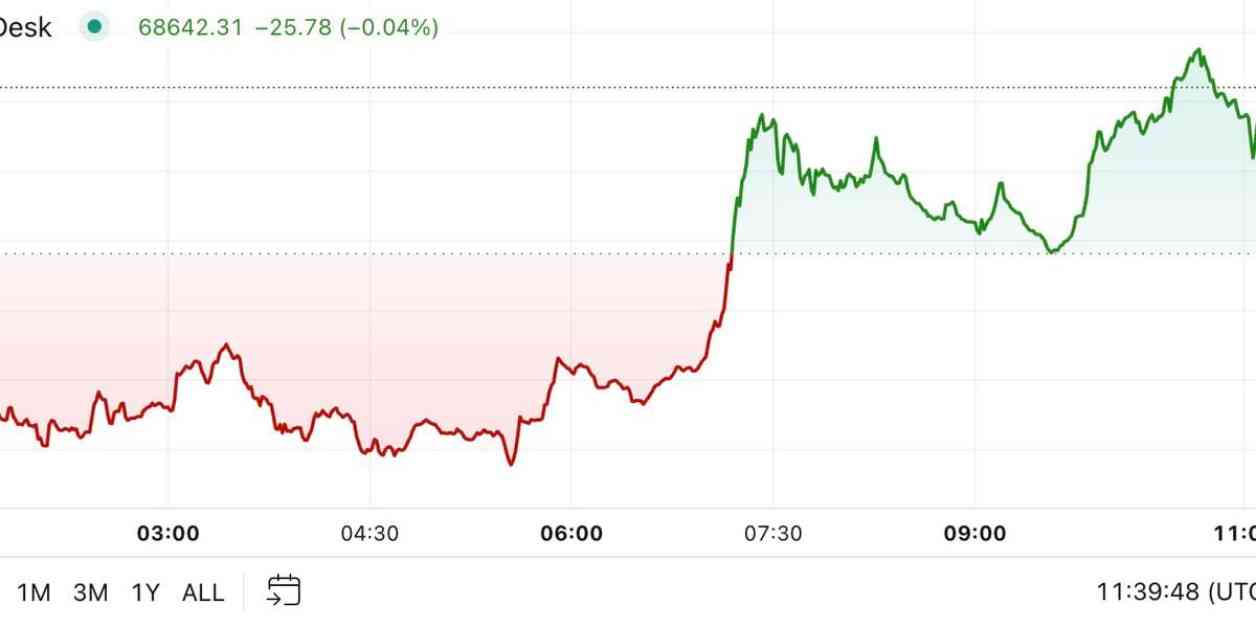

Bitcoin’s price has bounced back to $68,500 after a dip on Friday, according to the latest update from CoinDesk’s daily newsletter, First Mover. The cryptocurrency fell to as low as $65,700 late on Friday following reports of the Department of Justice probing Tether for violations of sanctions and anti-money laundering rules. However, Tether denied the report, leading to a quick recovery in Bitcoin’s price.

Over the weekend, Bitcoin erased its losses and rose over 2.4% in the last 24 hours to trade at nearly $68,700. Other cryptocurrencies like Ethereum (ETH) and Solana (SOL) have also seen similar gains, with the broader crypto market climbing over 2% as measured by the CoinDesk 20 Index. Dogecoin (DOGE) has experienced the healthiest bounce, trading around 6% higher at over $0.145.

A research report by Steno Research suggests that MicroStrategy’s premium to its Bitcoin stash may be unsustainable. The report indicates that the new provision for options on spot Bitcoin ETFs could reduce demand for MicroStrategy stock, impacting its premium. As regulators become more favorable towards Bitcoin and crypto investments, investors may opt to hold Bitcoin directly instead of investing in MicroStrategy stock.

In other news, Hong Kong Exchanges and Clearing is set to launch a virtual asset index series on November 15. The index will be administered and calculated by CCData, a UK-registered benchmark administrator and virtual asset data provider owned by CoinDesk. The index series will include reference indexes for Bitcoin and Ethereum, as well as reference rates for both cryptocurrencies. HKEX CEO Bonnie Y Chan hopes that providing transparent and reliable benchmarks will support informed investment decisions and strengthen Hong Kong’s position as an international financial center.

The chart of the day illustrates Bitcoin’s price alongside the year-on-year growth in the aggregate M2 money supply of major central banks like the U.S. Federal Reserve, European Central Bank, Bank of Japan, and People’s Bank of China. The M2 money supply grew by 7.5% last month, the fastest rate since November 2021. Previous Bitcoin bull runs have been associated with faster growth in the M2 money supply.

CoinDesk is a reputable media outlet covering the cryptocurrency industry with a commitment to editorial integrity and independence. The organization is part of the Bullish group, which invests in digital asset businesses. Journalists at CoinDesk may receive equity-based compensation from the Bullish group.