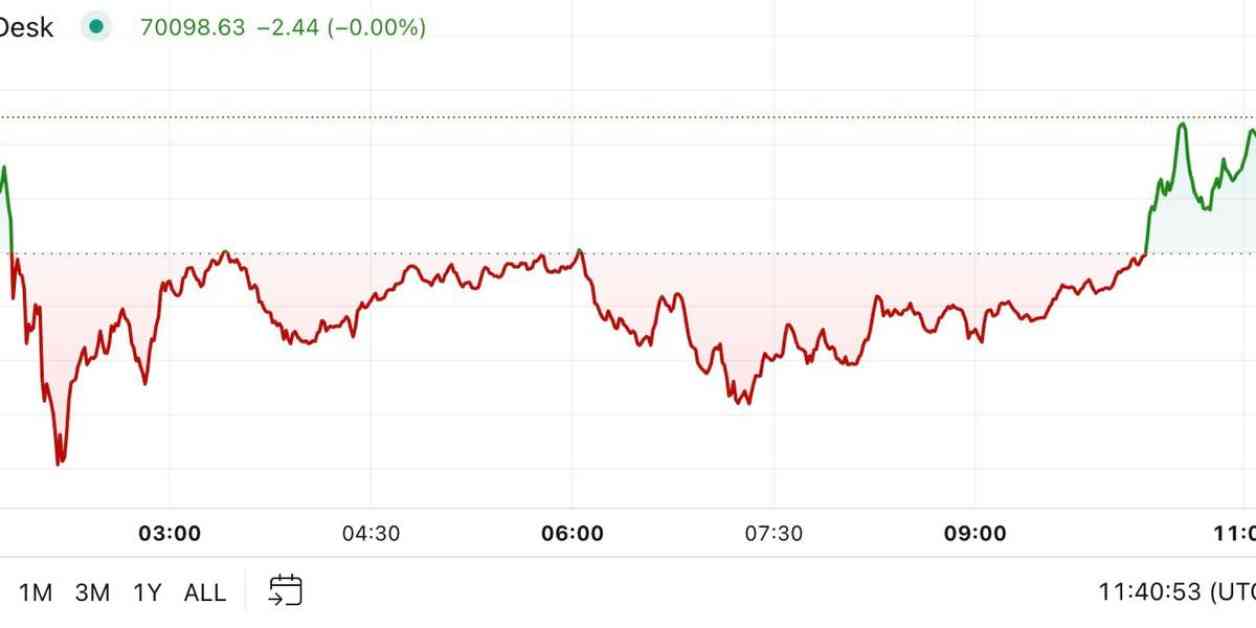

Bitcoin’s price has seen a slight recovery in the Americas after a recent decline. The price of Bitcoin dropped to $68,800 but then rose back to $70,000 during the European morning. However, it still remained about 3% lower in the last 24 hours. Altcoins, on the other hand, experienced greater losses, with the CoinDesk 20 Index showing a decrease of over 3.5% in the broader crypto market.

There are various explanations for this price movement, ranging from profit-taking after a rally earlier in the week to shifts in political odds on platforms like Polymarket. Traders have also been monitoring tech earnings, geopolitical tensions, and government budget announcements in different countries. Quinn Thompson, founder of crypto hedge fund Lekker Capital, mentioned these factors as influencers on the market.

Short-term holders of bitcoin have shown a tendency to panic sell when the price drops. On Thursday, as the price fell below $70,000, these holders sent over 32,000 BTC to exchanges at a loss. This panic selling was the most significant since early August. These short-term holders typically react to market emotions like fear and greed, leading to buying or selling decisions.

The odds of Kamala Harris winning the upcoming U.S. presidential election have been rising on betting platforms like Polymarket. This increase in Harris’ odds, along with a simultaneous decrease in Donald Trump’s odds, suggests changing market expectations. Some traders are hedging their positions by betting on both candidates. This strategy could explain the increase in Harris’ shares as a hedge against Trump bets.

In the world of cryptocurrency, Ethereum futures funding rates are showing a slight increase, indicating a potential uptick in bullish sentiment. This metric measures the balance between buyers and sellers in the futures market. Despite the recent rise, the funding rates are still lower than those seen in March. If the rates continue to climb, it could lead to a stronger and more sustained rally for Ethereum.

As a media outlet covering the cryptocurrency industry, CoinDesk follows strict editorial policies to ensure integrity and independence in its publications. CoinDesk is part of the Bullish group, which invests in digital asset businesses. It’s important to note that CoinDesk employees, including journalists, may receive compensation in the form of Bullish group equity. The publication aims to provide unbiased and credible information to its readers.