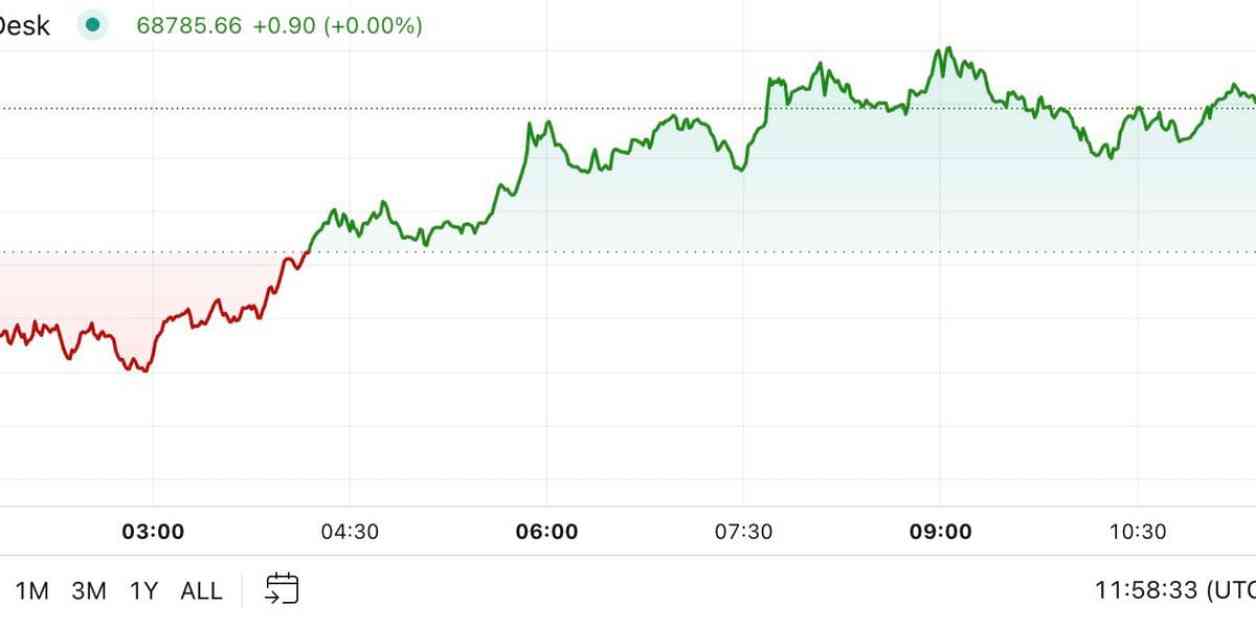

The cryptocurrency market in the Americas remains stable as the U.S. election unfolds, with Bitcoin hovering around $68,800 after recovering from a dip below $68,000. Traders are closely watching the presidential election for clues on the next market move, while also keeping an eye on Mt. Gox’s activity. The defunct exchange transferred over 32,000 BTC to unmarked wallets, potentially signaling an impending transfer to exchanges and applying selling pressure to BTC.

Despite the overall stability in the market, the CoinDesk 20 Index has fallen slightly by just over 0.5%. However, Dogecoin (DOGE) stands out as the only major token in the green, gaining nearly 10% in the last 24 hours. The meme coin has seen a resurgence in popularity thanks to Elon Musk’s support as part of the Republican campaign. Musk’s proposal of a Department of Government Efficiency (D.O.G.E), aimed at improving government spending and monetary planning, has boosted DOGE’s value by over 40% in the past month.

Bitcoin traders are hedging against potential downside risks following the election by purchasing put options expiring within the week. Put options give traders the right to sell the underlying asset at a predetermined price, providing a form of insurance against price drops. Analysts are closely monitoring the options market, with shorter-term contracts showing a slightly negative skew compared to longer-dated maturities.

In terms of market sentiment, analysts are anticipating a potential surge in the broader digital asset market following the election, regardless of the outcome. Many expect a marketwide rally to occur, driven by the uncertainty surrounding the election results and the potential impact on financial markets.

On the technical side, a chart of the daily dollar value of stablecoin flows on the Solana blockchain and Ethereum layer-2 network Base shows that Base is outpacing Solana in terms of stablecoin transfer volume. Base recorded a transaction volume of $18.1 billion on October 26, accounting for 30% of the global on-chain stablecoin activity.

Overall, the cryptocurrency market in the Americas remains resilient amidst the unfolding U.S. election. Traders are closely monitoring market developments and hedging their positions to navigate potential volatility in the coming days. The broader market sentiment remains positive, with expectations of a marketwide surge post-election, driven by a mix of political and economic factors.