The 2024 U.S. Election is unfolding with significant implications for the crypto industry. As the results come in, there are key updates on the candidates and their positions on digital assets.

Democratic Senator Elizabeth Warren, known for her skepticism towards crypto, retained her seat in Massachusetts despite a challenge from Republican John Deaton, a crypto supporter. Deaton, backed by XRP holders, fell behind Warren in the polls throughout the race.

On the Republican side, Representative Andy Barr from Kentucky secured his House seat, positioning himself as a potential leader in the House Financial Services Committee. Barr, supported by industry PAC Fairshake, has been a strong advocate for crypto legislation in Congress.

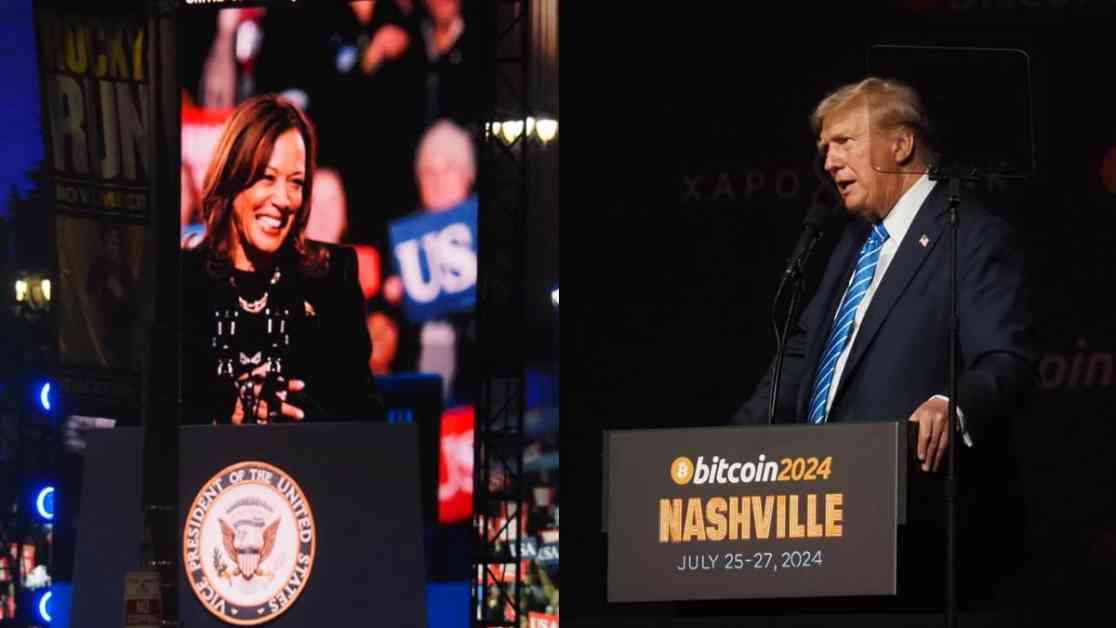

In other races, Donald Trump and Kamala Harris have been projected to win various states, with key victories shaping the electoral college landscape. The crypto community is closely watching these results, as they could impact the regulatory environment for digital assets.

The Super PAC Fairshake has emerged as a major player in the 2024 elections, raising $169 million to support candidates aligned with the crypto industry. Looking ahead to 2026, the PAC plans to carry over funds for future congressional races, signaling a long-term commitment to shaping a crypto-friendly U.S. Congress.

As the election outcome remains uncertain, prediction markets like Polymarket are indicating a close race between Trump and Harris in several swing states. The divided government scenario, with Democrats controlling the Senate and Republicans in the House, could provide a favorable environment for bipartisan crypto legislation.

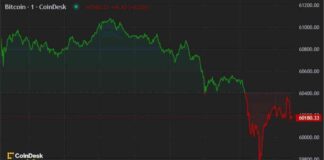

The crypto sector is hopeful for a post-election boost, following a challenging year for many digital assets. While Bitcoin has seen significant gains, other cryptocurrencies like Polygon, Cosmos, Polkadot, and Avalanche have struggled. Dogecoin, however, has emerged as a surprise winner in 2024.

Overall, the 2024 U.S. Election is a critical moment for the crypto industry, with the potential to shape regulatory policies and legislative priorities in the coming years. Stay tuned for more updates as the results unfold and their implications for digital assets become clearer.