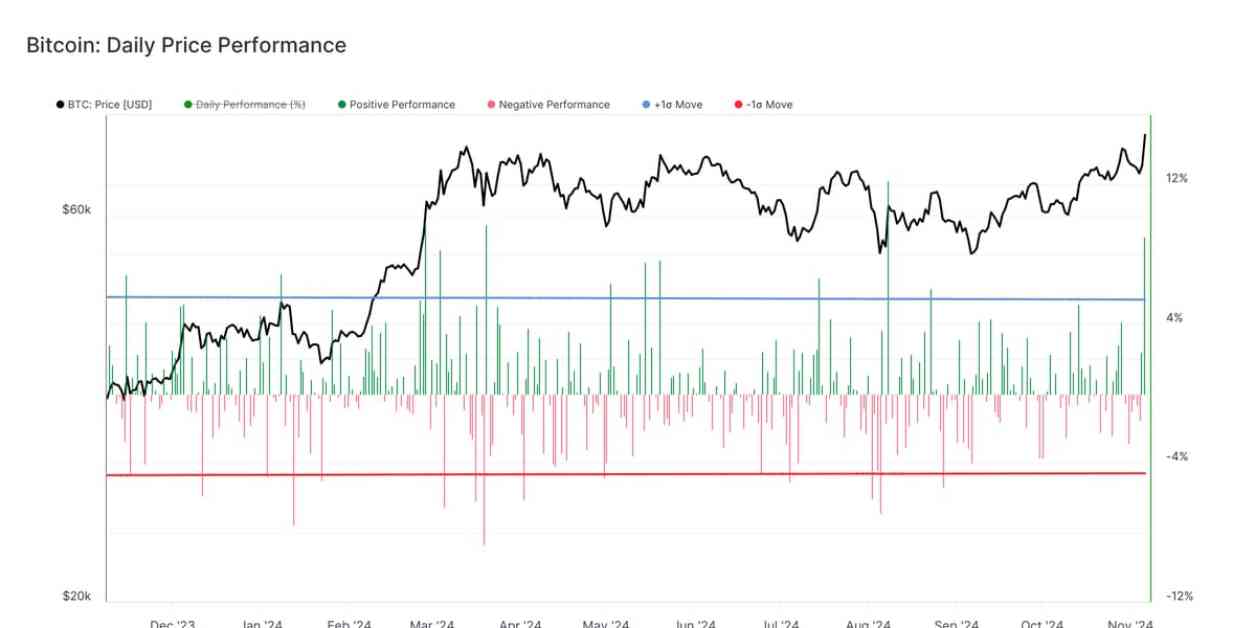

Bitcoin saw a significant surge on Wednesday, reaching a record high of $76,481, marking its fourth-best day of the year. This increase followed the U.S. presidential election victory of Donald Trump, who expressed support for the crypto industry during his campaign. Despite concerns about the sustainability of this gain, earlier research suggested that Bitcoin could rise by 11% on a Trump victory.

In conjunction with this rally, there were substantial inflows into spot bitcoin exchange-traded funds (ETFs), totaling a net of $621.9 million. This marked one of the highest figures since the introduction of these products in January. Total net inflows for Bitcoin ETFs have now reached $24.2 billion.

Notable performances included Grayscale’s Bitcoin Mini Trust (BTC) registering $108.8 million in inflows and Bitwise Bitcoin ETF (BITB) seeing $100.9 million in inflows. On the other hand, BlackRock’s iShares Bitcoin Trust (IBIT) experienced a second consecutive day of net outflows, losing $113.3 million over the period. Despite the outflows, IBIT saw record trading volume, indicating strong interest in the ETF.

Ether (ETH) has not performed as strongly as Bitcoin in 2024, with net inflows into U.S. spot ETFs totaling $52.3 million. Bitcoin’s year-to-date growth stands at 77%, trading at just over $75,000, while Ether is trading at $2,822, up 20% year-to-date.

Overall, the cryptocurrency market is experiencing significant activity, with ETF trade volume reaching its highest point since the early days of the asset class. While Bitcoin continues to lead the way, other cryptocurrencies like Ether are also seeing increased interest from investors.

As the industry continues to evolve and gain mainstream acceptance, it is essential to stay informed about the latest trends and developments in the cryptocurrency market. With the rise of ETFs and other investment vehicles, more opportunities are becoming available for both retail and institutional investors to participate in the crypto space.

The future of Bitcoin and other cryptocurrencies remains uncertain, but with the growing interest and adoption, it is likely that these digital assets will play an increasingly important role in the global financial system. By staying informed and educated about the market, investors can position themselves to take advantage of the opportunities presented by this emerging asset class.