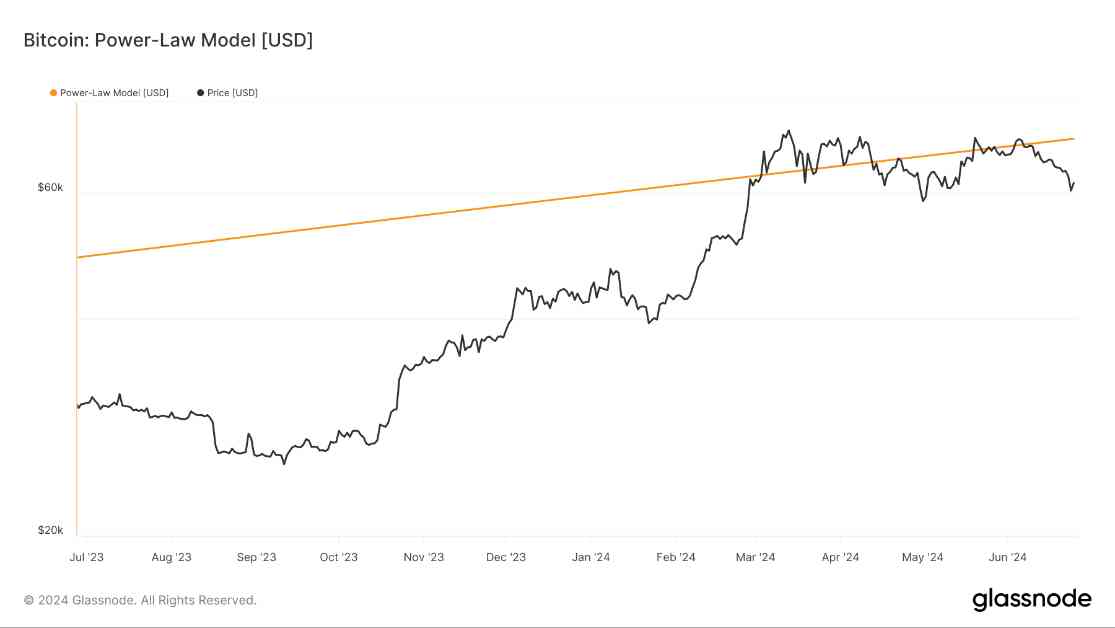

Bitcoin’s maturity after the 2024 halving is being forecasted using a power-law model. This model provides a mathematical description of Bitcoin’s historical price trends, showing a power-law distribution on a log-log scale. The analysis indicates a correlation between time and price, suggesting a potential long-term growth trajectory for Bitcoin.

Over the past decade, Bitcoin’s price movement has followed a power-law distribution, with consistent upward trends. The model illustrates periodic price surges and corrections, with significant volatility during the 2013 and 2017 bull runs. Despite retracements following peaks, the overall trend aligns with the power-law model’s projections.

Looking ahead to 2024, the model predicts a stabilizing pattern post-halving, reflecting the market’s maturity. The current price is closely in line with the model’s expected value, indicating behavior that aligns with historical trends. However, it is essential to approach future predictions with caution due to the model’s reliance on historical data and sequential price points.

As we consider the implications of this power-law model for Bitcoin’s future, it is crucial to acknowledge the factors that may influence its trajectory. Market sentiment, regulatory developments, technological advancements, and macroeconomic conditions all play a role in shaping Bitcoin’s price movements.

Investors and analysts should remain vigilant and continue to monitor these variables to make informed decisions about their Bitcoin holdings. While the power-law model provides valuable insights into Bitcoin’s historical trends, it is not a crystal ball for predicting the future with certainty.

By staying informed and adaptable in the ever-evolving cryptocurrency market, stakeholders can navigate the uncertainties and opportunities that lie ahead. As we approach the 2024 halving and beyond, the power-law model offers a framework for understanding Bitcoin’s potential growth, but it is essential to approach it with a critical eye and an awareness of the broader market landscape.