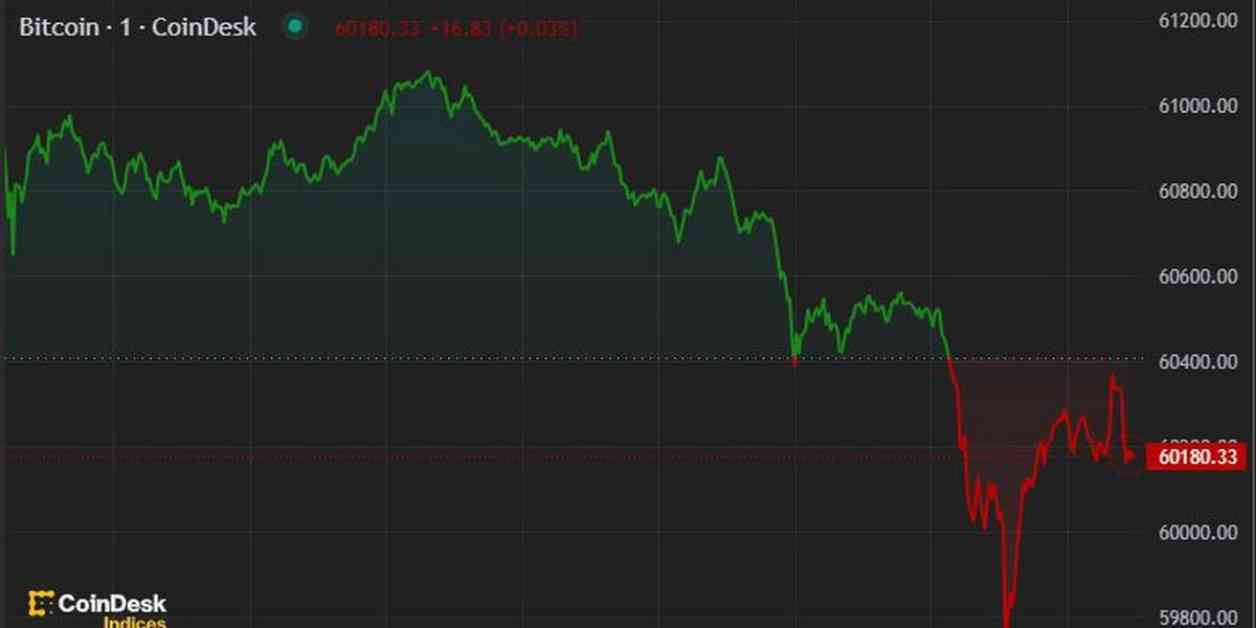

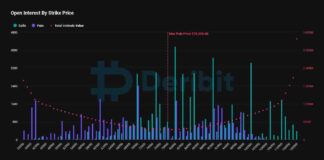

Bitcoin’s price has taken a hit in America, dropping to $60,000 during the European morning on Wednesday. This marks a 4% decrease in the last 24 hours, with BTC being the most affected among major cryptocurrencies. The broader digital asset market, as measured by the CoinDesk 20 Index (CD20), has also fallen by nearly 3.3%. These declines come after U.S. spot BTC ETFs saw $13 million of outflows on Tuesday, ending a five-day streak of inflows. Additionally, concerns about further selling pressure have arisen due to potential distributions by the defunct crypto exchange Mt. Gox. The uncertainty surrounding the release of up to 140,000 BTC from Mt. Gox is expected to weigh on the markets, especially since the exact release schedule remains unknown.

In other news, U.S. election-themed meme tokens are experiencing significant drops, with some down nearly 95% from their peak prices. For instance, Solana-based Jeo Boden (BODEN), a token inspired by Joe Biden, has plummeted by 70% in the past week and 80% in the last 30 days. Even tokens related to Donald Trump have seen declines, despite his electoral chances improving after the debate. The political finance (PoliFi) sector has contracted by 11% in the last 24 hours, contrary to expectations of a rally following the recent debate.

Despite these challenges, the crypto industry as a whole is entering a major growth phase, according to a quarterly report by investment bank Architect Partners. The report highlights that the value of the crypto industry has surged by over $750 billion in the first half of the year. Compared to two years ago, the industry is in a much stronger position, with the report describing crypto as “the stepchild of the internet” and surpassing the internet’s value at a similar stage of development. The report also draws parallels between crypto and the internet, noting their disruptive nature and the faster recovery of the cryptocurrency market compared to the internet after the dot-com bubble burst in 2000.

Looking at the charts, there is renewed selling pressure in BTC following a failed attempt by bulls to establish a foothold above the descending trendline, which has characterized the pullback from $72,000. The next significant support level is seen at the late April low of $56,500.

As the crypto industry continues to evolve and face challenges, it is important for investors and stakeholders to stay informed and adapt to market developments. The future of cryptocurrencies remains uncertain, but with resilience and strategic planning, the industry can overcome obstacles and continue to grow in the long term.