Bitcoin Price Plummets Below $57K Amidst Ongoing ‘Sell-on-Rise’ Trend

Bitcoin (BTC) faced a significant drop below $57,000 on Thursday, reversing the gains it had seen the day before. This downward trend comes as concerns about the strength of the U.S. economy continue to linger, prompting investors to sell off risk assets as they try to rebound from recent losses.

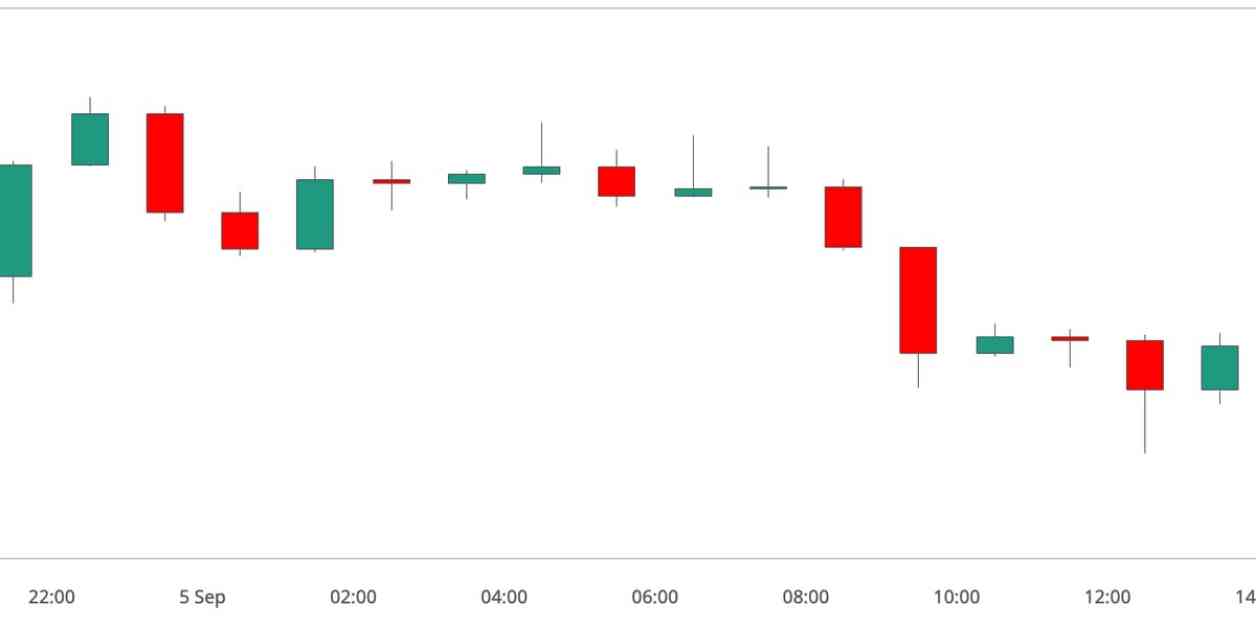

The leading cryptocurrency by market value fell over 2% to $56,700, failing to maintain its position above $58,000 on Wednesday. Just a week ago, prices had peaked above $65,000 on August 25th before beginning a steady decline, marked by brief and shallow bumps along the way. This pattern reflects a persistent “sell-on-rise” mentality among investors, indicating a lack of confidence in sustained growth.

Notably, other cryptocurrencies such as ether (ETH), XRP, and TON also experienced losses, erasing any gains made on Wednesday as they traded mostly unchanged over a 24-hour period. The broader crypto market as measured by the CoinDesk 20 Index (CD20) was up by just 0.9% recently, highlighting the overall weakness in the sector.

Analysts suggest that the sell-on-rise bias is rooted in growing concerns over the potential for a U.S. recession, leading investors to reduce their exposure to risk assets like cryptocurrencies. Valentin Fournier, an analyst at digital assets advisory firm BRN, pointed to economic indicators such as the ISM manufacturing index and job openings data as signs of trouble ahead.

“Economic reports are increasingly suggesting the risk of a recession should not be discounted,” Fournier stated. “The ISM manufacturing index has fallen 0.5% below expectations, and job openings are at 7.7 million compared to the anticipated 8.1 million.”

Given the current economic uncertainties and the possibility of decreased liquidity, Fournier recommended reducing exposure to BTC and waiting for a more favorable entry point before increasing investments. The recent Job Openings and Labor Turnover Survey (JOLTS) data from the U.S. Bureau of Labor Statistics, which missed market expectations, and the pessimistic tone of the Federal Reserve’s Beige Book only added to the negative sentiment.

The weak economic data has reignited speculation about potential Federal Reserve interest-rate cuts, though this has not yet provided support for BTC’s price. Alex Kuptsikevich, senior market analyst at The FxPro, raised concerns about the broader implications of bitcoin’s weakness for traditional risk assets in financial markets.

“It is possible that the weakness in cryptocurrencies is a manifestation of a very limited risk appetite, and the rest of the markets may soon follow the lead of cryptocurrencies,” Kuptsikevich noted. He observed that BTC’s failure to sustain gains above the 200-day average had triggered a more intense sell-off, with the price now testing lows not seen in the last four months.

Overall, the uncertain economic outlook and the lack of sustained positive momentum in the crypto market are keeping investors on edge. As bitcoin continues to struggle, it serves as a cautionary signal for the broader financial landscape, indicating a general aversion to risk-taking.

Implications for Crypto Markets

The recent downturn in bitcoin and other cryptocurrencies underscores the interconnected nature of global financial markets. Cryptocurrencies have increasingly become intertwined with traditional assets, with their performance often reflecting broader market sentiment.

As investors seek safe havens amidst economic uncertainty, cryptocurrencies may face continued selling pressure in the short term. This could lead to further volatility in the crypto market, as traders navigate the shifting landscape of risk and reward.

Outlook for Bitcoin

Despite the current challenges facing bitcoin, some analysts remain optimistic about its long-term prospects. The underlying technology and growing adoption of cryptocurrencies suggest a promising future for bitcoin and other digital assets.

However, in the near term, market participants should exercise caution and closely monitor economic developments that could impact crypto prices. As the U.S. economy grapples with potential headwinds, bitcoin’s price trajectory may remain uncertain.

Conclusion

In conclusion, the recent drop in bitcoin’s price below $57,000 reflects broader concerns about the U.S. economy and its implications for risk assets. As investors adopt a “sell-on-rise” approach, cryptocurrencies like bitcoin face renewed selling pressure, highlighting the interconnected nature of financial markets.

While the short-term outlook for bitcoin remains uncertain, its long-term potential as a digital asset with widespread utility and adoption remains intact. As the crypto market navigates these challenging times, investors should remain vigilant and informed to make sound decisions in a rapidly evolving landscape.