Bitcoin has surged past the $65,000 mark, experiencing a 4% increase in just 24 hours. This rise is attributed to positive movements in the S&P 500 and expectations of stimulus in China. The trading firm QCP Capital has pointed out similarities between the current price actions of Bitcoin and those observed before the U.S. elections in 2016 and 2020. They suggest a pattern where Bitcoin sees significant gains in the weeks leading up to the election, leading to ‘Uptober’ optimism.

The S&P 500 has also reached a new high, indicating a bullish trend in the market, which often aligns with the performance of cryptocurrencies. Bitcoin’s rise to over $65,000 during U.S. morning trading hours on Monday coincided with the S&P 500 index hitting fresh highs. Some traders believe that historical price patterns observed before previous U.S. presidential elections may provide a reason to be optimistic ahead of the upcoming November vote.

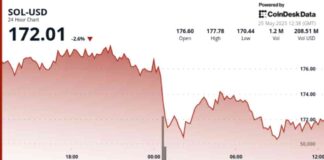

BTC has seen a 4% increase in the past 24 hours, with the CoinDesk 20 (CD20) also up by 3.1%. The S&P 500 rose by 0.25% at the open to 5,829.81, setting the stage for a week filled with corporate earnings and economic data. The rally from $62,000 to $65,000 in Bitcoin came as hopes for future stimulus in Chinese markets were renewed, driving up the prices of riskier assets, including cryptocurrencies.

According to QCP Capital, the recent price action in Bitcoin resembles what was seen before the U.S. elections in 2016 and 2020. In both instances, Bitcoin traded within a narrow range for an extended period before starting a rally a few weeks before the election day. This historical pattern has sparked optimism in the market, especially as October has historically been a bullish month for investors.

Despite the recent stability in Bitcoin prices over the past two weeks, the cryptocurrency is up slightly on a month-to-date basis. Historical analysis shows that most gains in October tend to occur in the second half of the month, with price increases of up to 16% typically happening after October 15th.

As the market continues to show signs of optimism and bullish trends, investors are closely watching how Bitcoin will perform in the coming weeks leading up to the U.S. elections. The correlation between traditional financial markets like the S&P 500 and the performance of cryptocurrencies like Bitcoin is becoming increasingly evident, highlighting the interconnected nature of these asset classes.