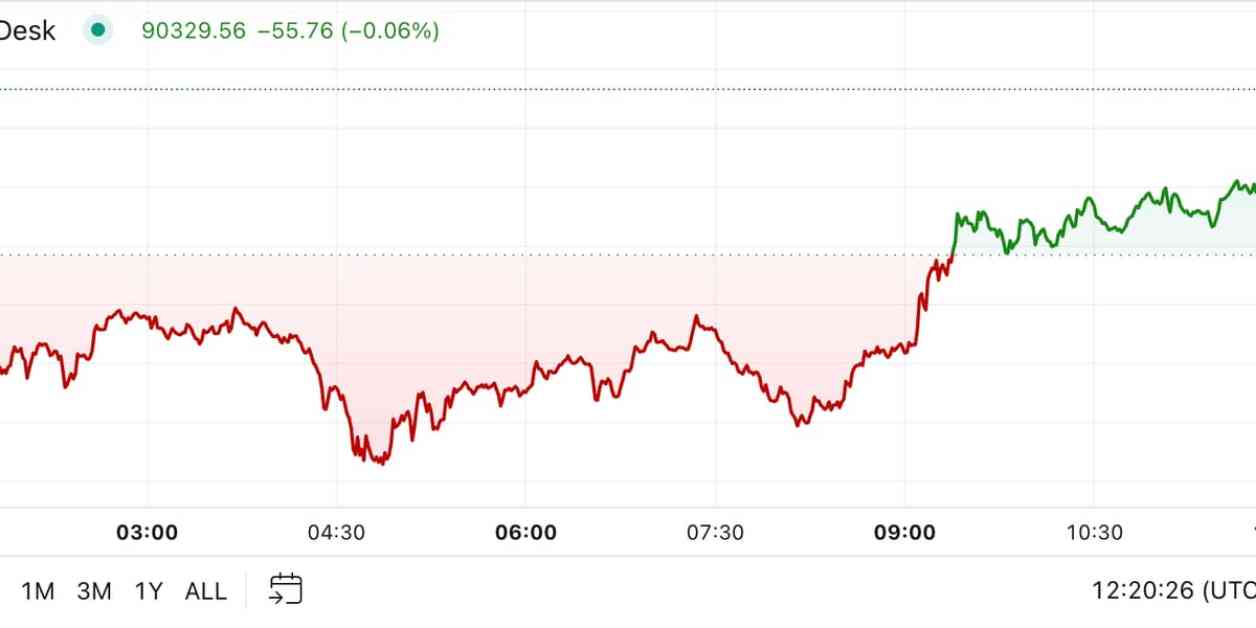

Bitcoin traders in the Americas are securing profits as the cryptocurrency market experiences volatility in recent days. Bitcoin, the leading cryptocurrency, managed to recover some of its losses during the European morning, trading above $90,000. However, it remains over 1% lower in the last 24 hours, indicating a possible profit-taking scenario after reaching a high above $93,000 earlier in the week.

The drop in Bitcoin prices was triggered by Federal Reserve Chair Jerome Powell’s hawkish comments, where he mentioned that there is no rush to lower interest rates based on current economic signals. This statement dampened hopes of swift interest-rate cuts, leading to a decrease in market expectations for a rate cut at the December Federal Open Market Committee (FOMC) meeting.

Bitcoin exchange-traded funds (ETFs) saw significant outflows of $400 million on Thursday, marking the third-highest loss since their listing in January. This trend suggests that investors are taking profits, similar to the dip observed in the underlying asset. Notably, BlackRock’s IBIT saw inflows of $126.5 million, indicating continued interest in Bitcoin ETFs since November 7th.

In the midst of this volatility, XRP, another popular cryptocurrency, surged 17% in 24 hours, outperforming Bitcoin and other major cryptocurrencies. This increase in XRP’s price was supported by a shifting regulatory climate in the United States, which has boosted tokens previously affected by regulatory actions from the Securities and Exchange Commission (SEC). The positive sentiment surrounding XRP is also fueled by the legal actions taken by 18 U.S. states against the SEC and its commissioners, accusing them of overreaching in regulating the crypto industry.

Looking at the technical analysis, Bitcoin’s price movement suggests a potential breakout above the $94,000 mark if it manages to surpass the overhead trendline resistance. However, a dip below the 100-hour simple moving average (SMA) support could lead to a deeper slide towards the 200-hour SMA at $82,600. Traders are closely monitoring these key levels to make informed decisions in the volatile market.

Overall, the cryptocurrency market in the Americas is witnessing fluctuations driven by various factors such as regulatory developments, investor sentiment, and macroeconomic conditions. Traders are advised to stay informed and exercise caution while navigating the dynamic landscape of digital assets.