Bitcoin has defied the odds once again, showcasing remarkable resilience in the typically bearish month of September. The largest cryptocurrency surged 22% from its monthly low of around $52,500, challenging the negative reputation that often surrounds this time of year for investors. As Bitcoin continues to push higher, all eyes are now on the critical $65,200 mark, with market participants eagerly watching to see if it can break out of its current downtrend.

With Bitcoin approaching this pivotal point in its trading channel, there is a sense of anticipation in the crypto community. The cryptocurrency’s ability to push past the $65,200 mark could signal a significant shift in its trading behavior, potentially leading to unexpected and substantial moves in the market. As investors eagerly wait to see how Bitcoin will perform in the coming days, it’s clear that the digital asset continues to capture the attention of traders and analysts alike.

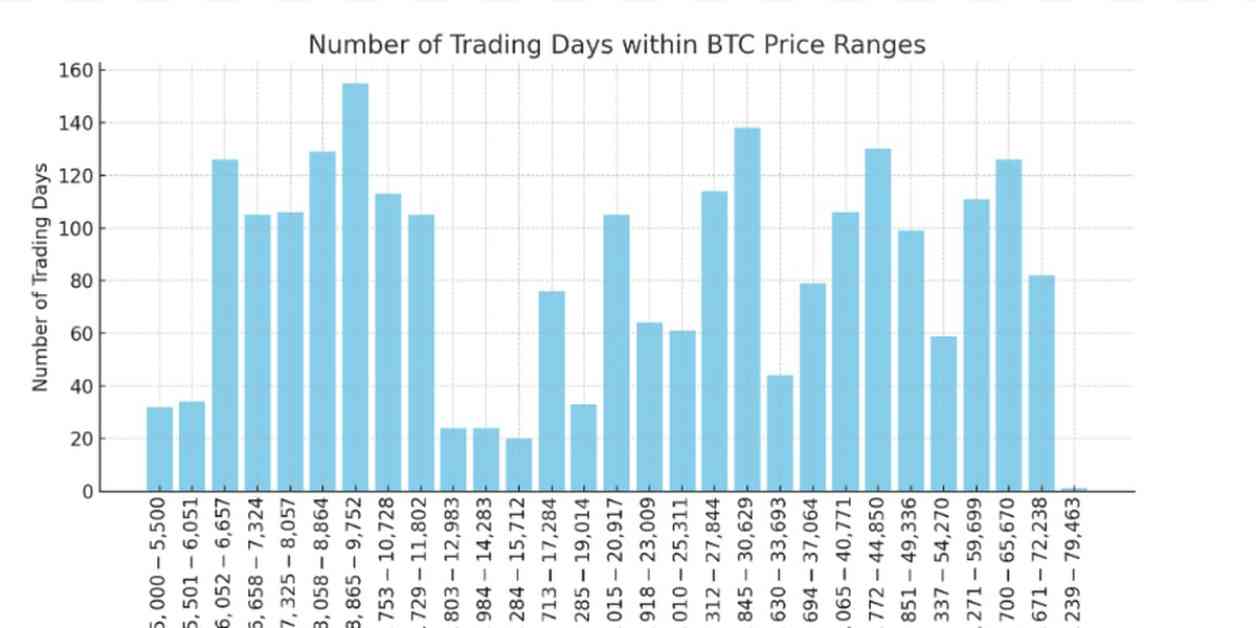

To gain a deeper understanding of Bitcoin’s trading behavior, analysts have turned to a 10% price increment analysis system. This method provides a more accurate comparison of Bitcoin’s movements by focusing on percentage changes rather than fixed dollar amounts, which can sometimes distort the analysis. By looking at how Bitcoin moves relative to its own value, investors can better predict potential shifts in the market and make more informed trading decisions.

One interesting finding from this analysis is the length of Bitcoin’s trading ranges over the years. For example, during the 2018-2019 market cycle, Bitcoin traded between $8,865 and $9,752 for a staggering 155 days. This period of consolidation coincided with the aftermath of the 2017 bull-market peak and the recovery that began in mid-2019. Similarly, in the current cycle, Bitcoin has spent 111 days trading between $54,271 and $59,699, and has been in a range of $59,700 to $65,670 for 126 trading days. This historical perspective highlights Bitcoin’s tendency to trade in extended cycles of consolidation before making significant moves in the market.

Looking ahead, it’s important for investors to remain patient and consider these long-term trends as Bitcoin approaches critical levels. While the current downtrend may seem unending, historical data suggests that breakouts often come when least expected. By understanding Bitcoin’s trading ranges and past behaviors, investors can better position themselves to capitalize on potential future market movements.

One positive aspect of the current cycle is the muted drawdowns compared to previous cycles. Bitcoin has experienced minimal volatility in recent months, with the largest decline being just under 30%. This stability is crucial for new institutional investors who may be more risk-averse and unable to handle extreme price swings. As Bitcoin continues to demonstrate resilience in the face of external pressures, it’s clear that the digital asset is maturing and becoming more attractive to a broader range of investors.

In the third quarter of this year, Bitcoin has seen modest gains, up by less than 1% with only a few trading days remaining. Despite facing challenges such as a sale by the German government and Mt. Gox redemptions, Bitcoin has managed to maintain its position in the market. The third quarter is traditionally the weakest for Bitcoin, according to Coinglass, but the cryptocurrency’s ability to weather these headwinds speaks to its enduring appeal among investors.

As we look towards the future, it’s essential to keep a close eye on Bitcoin’s movements and be prepared for potential breakout moments. While the market may seem stagnant at times, history has shown that significant opportunities can arise when least expected. By staying informed and understanding Bitcoin’s trading patterns, investors can navigate the market with confidence and seize opportunities as they arise.

Conclusion

In conclusion, Bitcoin’s resilience in September has once again defied expectations and showcased the digital asset’s ability to overcome challenges. As the cryptocurrency approaches critical levels and traders eagerly await a potential breakout, it’s clear that Bitcoin continues to captivate the attention of investors worldwide. By analyzing Bitcoin’s trading behavior and historical trends, investors can gain valuable insights into the market’s potential future direction and position themselves for success in the ever-evolving world of cryptocurrency.