Bitcoin traders are keeping their eyes firmly on the prize, with the leading cryptocurrency hovering below the tantalizing $100,000 mark. Despite the lackluster performance, traders are not shying away from optimistic bets on BTC. One particular strategy has emerged as the top choice this month, capturing the attention of market watchers and enthusiasts alike.

The most favored options play in February involves purchasing the $110,000 call expiring on March 28. According to Amberdata’s Deribit options flow, traders have collectively paid over $6 million in net premiums for this bullish position. A call option grants the buyer the right, though not the obligation, to buy the underlying asset at a pre-determined price on or before a specific date. In essence, call buyers are expressing bullish sentiments about the market’s future performance.

Greg Magadini, Director of Derivatives at Amberdata, noted that the buying of March $110K calls has been the most active trade among on-screen traders this month. Despite Bitcoin’s price oscillating between $95,000 and $100,000, traders remain hopeful. Positive developments, such as MicroStrategy’s continued accumulation of BTC and Abu Dhabi’s substantial investment in bitcoin ETFs, have provided some support for the bulls.

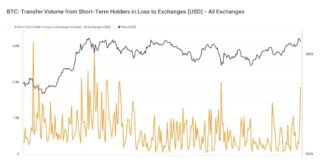

However, macroeconomic challenges, exemplified by the recent surge in U.S. inflation rates and the erratic behavior of memecoins and small-cap tokens, are putting a lid on the upward potential. Over the weekend, the crypto market witnessed a whirlwind as the token LIBRA surged to a $4 billion market cap only to plummet by 90% within minutes. Argentina’s President, Xavier Milei, inadvertently caused a stir by initially endorsing the coin, sparking a controversy that landed him in legal hot water.

Greg Magadini commented on the market dynamics, highlighting the disconnect between bullish headlines and actual price movements. Despite positive news like Abu Dhabi’s investment, Bitcoin prices failed to see a significant spike due to the overshadowing influence of bearish memecoin activities. The volatile nature of the market, characterized by sudden drops and pumps, combined with an influx of altcoins, has kept BTC in a state of stagnation.

Expert Insights from Omkar Godbole

Omkar Godbole, Co-Managing Editor on CoinDesk’s Markets team in Mumbai, brings a wealth of experience and knowledge to the table. With a Master’s degree in Finance and a Chartered Market Technician (CMT) designation, Omkar is well-versed in the intricacies of the financial world. His background includes research on currency markets and fundamental analysis of currencies and commodities at Mumbai-based brokerage firms.

Omkar’s perspective sheds light on the current market conditions, pointing towards a sideways trend with lower volatility. Despite the positive signals from institutional investors and favorable headlines, the overarching influence of memecoins and alternative cryptocurrencies is keeping Bitcoin in a holding pattern.

As traders eagerly await a breakthrough above the $100,000 mark, the options market remains abuzz with activity. The $110,000 call option continues to dominate the scene, reflecting traders’ unwavering confidence in Bitcoin’s future trajectory. Amidst the ebbs and flows of the crypto world, the allure of potential gains keeps traders engaged, eagerly anticipating the next move in the ever-evolving landscape of digital assets.