BTC Price Analysis: First Mover Americas Sees Little Change, Set to Close August with 8% Decline

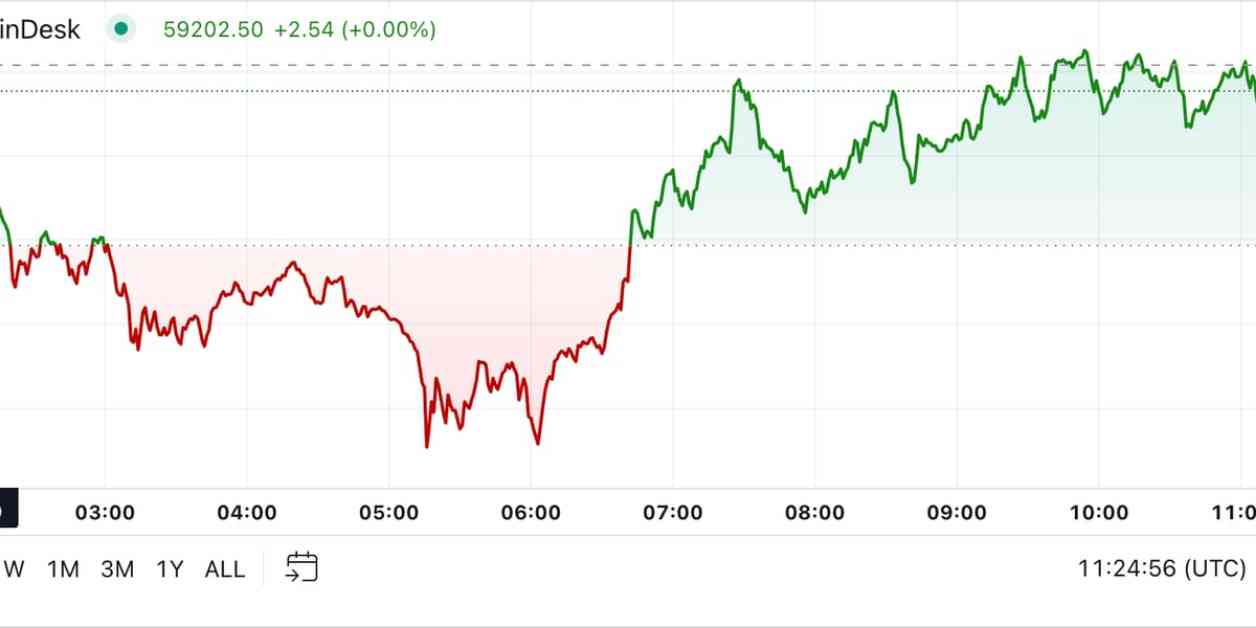

The cryptocurrency market has seen relatively muted price movements as the week comes to a close, with Bitcoin (BTC) experiencing a 0.7% decrease over the last 24 hours, settling at $59,500. The broader digital asset market, as measured by the CoinDesk 20 Index, has also dropped by 1.5%. This decline comes as Bitcoin continues to extend its week-long slide following a brief rally last week. Major exchange-traded funds (ETFs) have recorded net outflows, signaling a potential decrease in demand for BTC. As August comes to a close, Bitcoin is on track to experience an 8% decline, marking the steepest drop since April. Demand growth for Bitcoin remains low overall, with some weeks even showing negative growth.

Despite the overall downward trend, Dogecoin has managed to defy the odds by rising nearly 0.7%. A lawsuit alleging that Elon Musk and Tesla manipulated the price of DOGE through Musk’s social media influence and public statements was recently dismissed by a Manhattan judge. The lawsuit cited Musk’s statements claiming to “become Dogecoin’s CEO,” place a “literal Dogecoin in SpaceX and fly it to the moon,” and promote Dogecoin as a potential global financial standard. Judge Alvin Hellerstein deemed these statements as “aspirational and puffery,” rather than factual claims that investors would rely on for investment decisions.

In other news, crypto startup Bridge, which aims to establish a global stablecoin-based payments network, has secured $40 million in fresh funding, bringing its total raised amount to $58 million. Founded by Zach Abrams and Sean Yu, former employees of Square and Coinbase, Bridge seeks to simplify the use of stablecoins for companies without the need for complex integrations. The startup’s vision is to become a Web3 version of payments processor Stripe, providing a seamless global payments system for developers to utilize. Among Bridge’s notable customers are SpaceX and Coinbase, highlighting the growing interest in stablecoin-based payment solutions.

As we look at the broader market trends, it’s worth noting that every single MSCI country stock index is currently above its 200-day moving average. This figure serves as an indicator of bullishness in the stock market, with potential correction risks looming when it surpasses 90%. The movement of the stock market can often influence the cryptocurrency market, as both are impacted by similar factors. Understanding these correlations can provide valuable insights for investors and traders navigating the volatile world of digital assets.

In conclusion, the cryptocurrency market continues to experience fluctuations as we near the end of August. While Bitcoin faces challenges with declining demand and price corrections, other tokens like Dogecoin showcase resilience amidst market pressures. The emergence of innovative startups like Bridge highlights the ongoing evolution of the crypto industry, with a focus on improving payment solutions and accessibility for businesses worldwide. Keeping a close eye on market trends and developments is crucial for investors looking to navigate the ever-changing landscape of digital assets.