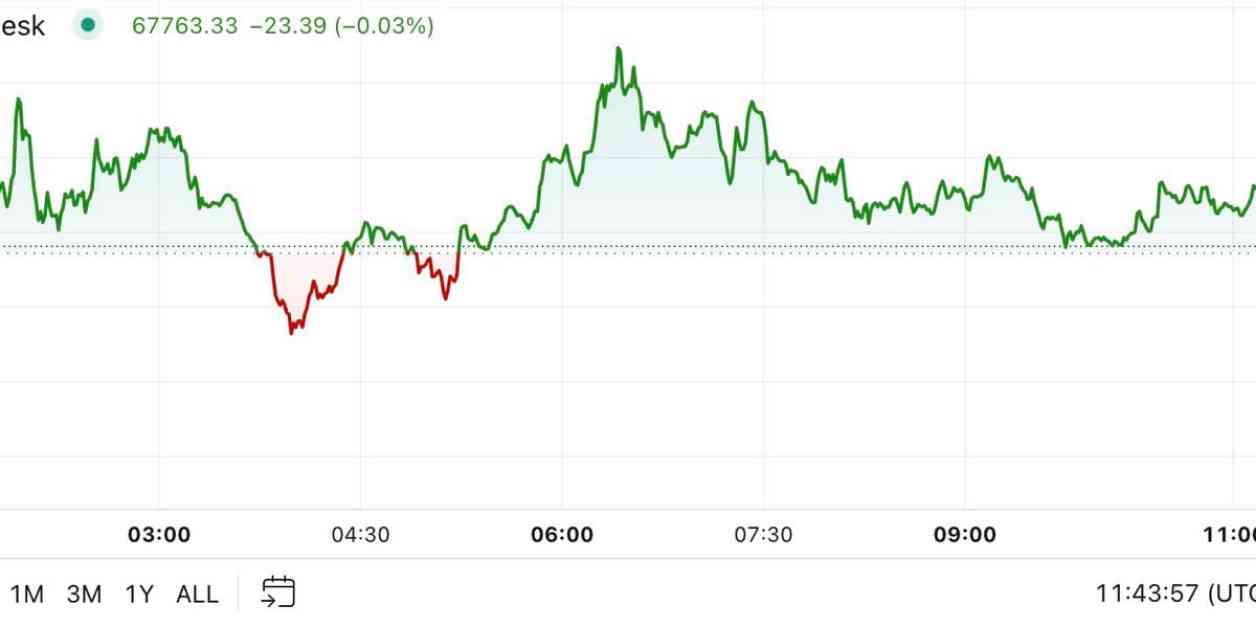

Bitcoin’s price surged near $68,000 as the First Mover Americas ETF inflows drove momentum in the market. The cryptocurrency attempted to establish itself above $68,000 before pulling back and settling around $67,800. In the last 24 hours, Bitcoin has gained about 1.35%, outperforming the broader digital asset market. This week alone, Bitcoin has risen nearly 9%, fueled by strong demand for spot BTC ETFs.

U.S.-listed funds have seen inflows of $1.86 billion since Monday, marking their highest tally since March. Globally, bitcoin ETPs have experienced their best week since July, with a cumulative inflow of 25,675 BTC ($1.74 billion) in the past seven days. This surge in investment reflects the growing interest in Bitcoin as it continues its rally.

Meanwhile, Dogecoin saw a significant jump as Elon Musk revealed plans for his proposed “Department of Government Efficiency” at a Pennsylvania town hall. The cryptocurrency rose over 9% to over 13 cents, outperforming the broader market and Bitcoin. Musk’s involvement in Republican politics has also contributed to Dogecoin’s recent gains.

In terms of transaction fees, Bitcoin’s fees spiked to $67,300, the highest single-day tally since August. This increase was likely driven by renewed bullish price action in Bitcoin-based memecoins. The chart showing daily Bitcoin transaction fees in USD and BTC’s price highlights this spike in fees.

Overall, the cryptocurrency market continues to see positive momentum, with Bitcoin leading the way in terms of price appreciation and investor interest. As more institutional investors and retail traders flock to digital assets, the market is poised for further growth and development in the coming weeks.