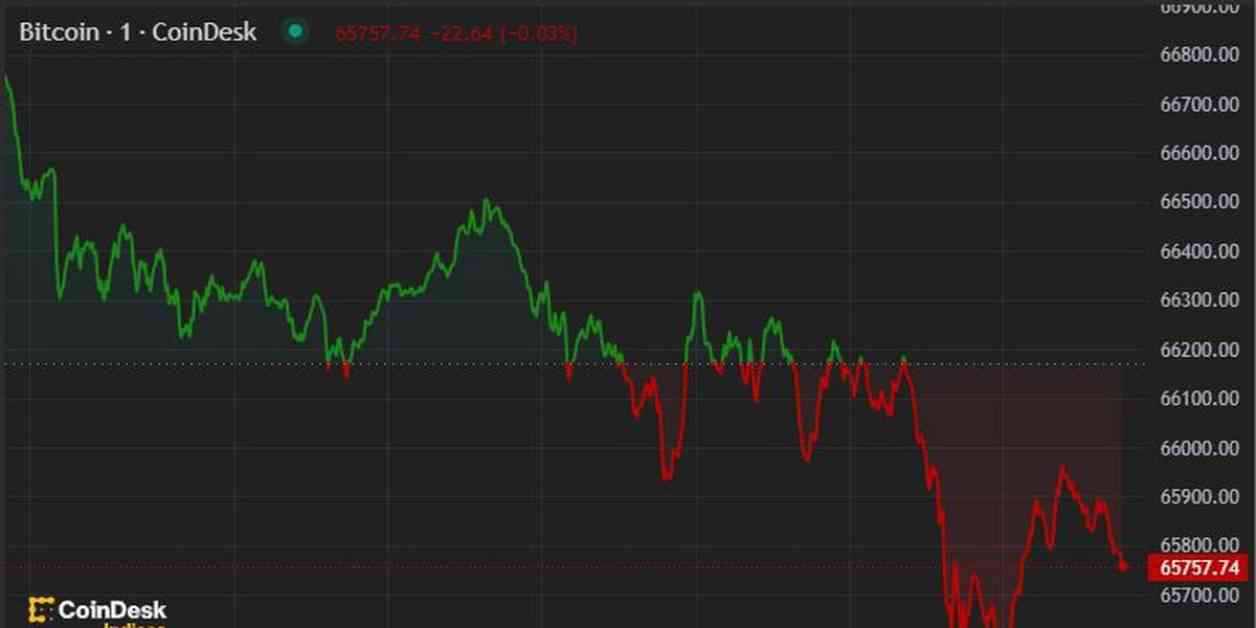

The cryptocurrency market experienced a downturn following the Federal Reserve’s decision to reduce interest-rate cut expectations. Bitcoin and ether both saw a 1% decrease in their value over a 24-hour period. Bitcoin was trading just below $66,000, while ether was quoted around $3,500. The broader crypto market, as measured by the CoinDesk 20 Index, fell about 1.8%.

During the European morning, meme coins like SHIB and DOGE led the declines, with SHIB losing 3.5% and DOGE dropping 1.7%. U.S.-listed bitcoin miners reached a record market cap of $22.8 billion on June 15, with Core Scientific being the best performer, adding 117%, and Argo Blockchain dropping 7%. Despite this, bitcoin mining stocks gained in the first half of the month, especially after Core Scientific’s deal with CoreWeave.

The Financial Stability Board (FSB) announced that it will be conducting further work on the challenges posed by stablecoins in emerging and developing economies. This decision was made during a meeting in Toronto of the FSB’s plenary. The FSB has been actively involved in shaping global crypto policy, having previously worked with the International Monetary Fund on a joint policy paper on crypto.

It is important to note that CoinDesk, the source of this information, is an award-winning media outlet that covers the cryptocurrency industry. The publication was acquired by the Bullish group in November 2023, which is majority-owned by Block.one. CoinDesk operates independently with an editorial committee to ensure journalistic independence. Employees, including journalists, may receive options in the Bullish group as part of their compensation.