Cryptocurrency Market Faces Uncertainty as White House Backpedals on Reserve Plan

In a surprising turn of events, the cryptocurrency market experienced a significant drop in prices following a White House official’s clarification on President Trump’s recent announcement regarding the formation of a strategic crypto reserve. The official stated that the President was merely providing examples of cryptocurrencies that could potentially be included in the reserve, rather than confirming their selection.

The announcement, made on March 2, initially sparked excitement and speculation within the crypto community. President Trump had declared his intention to establish a U.S. crypto reserve that would include popular digital assets such as ADA, XRP, and SOL. However, the subsequent clarification by the White House official dampened expectations and led to a decline in the prices of these tokens.

Market Reaction and Concerns

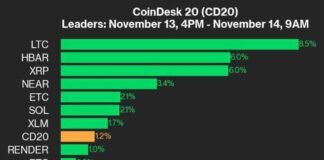

Following the official’s statement, Cardano’s ADA, XRP, and Solana’s SOL experienced notable price drops. ADA plummeted over 5% to $0.82, XRP slid 3.5% to $2.41, and SOL was down 2%. This downward trend was further exacerbated by a weak overall performance in the cryptocurrency market, with Bitcoin also experiencing a decline to $87,000 after giving up early morning gains.

The inclusion of altcoins such as ADA and XRP in the proposed strategic reserve raised concerns among industry experts about potential corruption and self-dealing. Many viewed the move as a departure from traditional cryptocurrency practices and a potential risk to the market’s integrity. The skepticism surrounding the plan added to the market’s uncertainty and contributed to the price fluctuations observed in various digital assets.

Expert Insights and Industry Response

Senior executives and industry leaders gathered in Washington, D.C., for the White House’s first crypto summit, where the implications of the proposed crypto reserve were discussed. Companies such as Ripple, Gemini, Robinhood Crypto, and Crypto.com were present to engage in dialogue about the future of the cryptocurrency market and regulatory landscape.

Krisztian Sandor, a U.S. markets reporter with a focus on stablecoins and tokenization, highlighted the potential impact of the White House’s decision on the industry. He emphasized the need for clarity and transparency in government-led initiatives involving cryptocurrencies to maintain market stability and investor confidence.

Jesse Hamilton, CoinDesk’s deputy managing editor specializing in global policy and regulation, underscored the importance of regulatory oversight in the crypto space. Drawing from his extensive experience covering Wall Street regulation, Hamilton emphasized the need for a balanced approach that fosters innovation while safeguarding against potential risks and abuses.

As the cryptocurrency market continues to navigate through evolving regulatory landscapes and policy developments, industry stakeholders remain vigilant in their efforts to promote responsible practices and sustainable growth. The recent market turbulence serves as a reminder of the interconnected nature of the digital asset ecosystem and the importance of clear communication and informed decision-making.

The situation surrounding the White House’s backpedaling on the crypto reserve plan underscores the need for a nuanced approach to regulatory initiatives in the cryptocurrency space. As market participants and policymakers work towards a harmonious coexistence, the future of digital assets remains a dynamic and evolving landscape that requires thoughtful consideration and collaborative engagement.