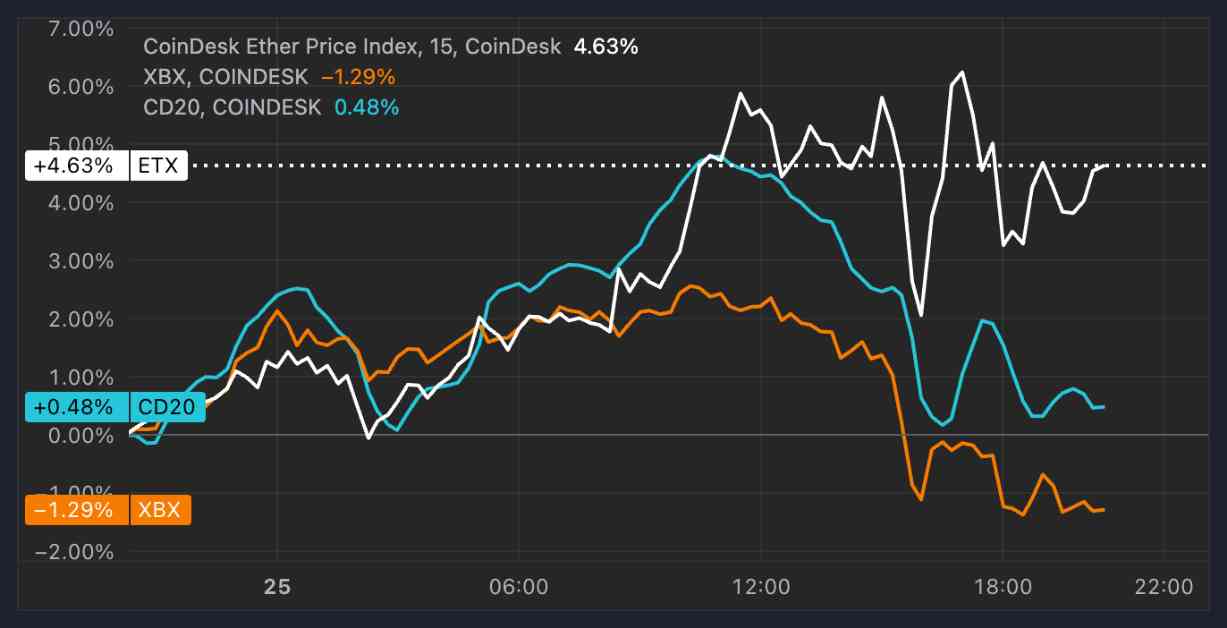

Ether has been gaining momentum in the cryptocurrency market as bitcoin’s rally has hit a roadblock, allowing ETH to outperform BTC. In the past 24 hours, Ethereum has surged by over 4%, while bitcoin has experienced a 1.5% dip, falling below $95,000. This shift in performance has caught the attention of investors, who are now rotating their capital towards smaller, riskier cryptocurrencies like ETH.

The ETH/BTC ratio, which measures the strength of ether against bitcoin, had dropped to its lowest level since March 2021 but has since rebounded by 15%. This indicates that investors are starting to favor ether over bitcoin in the short term. According to digital asset hedge fund QCP, the options market also reflects this sentiment, with ETH calls being more heavily favored compared to BTC calls.

Josh Lim, co-founder of Arbelos Markets, noted that there is a noticeable rotation from BTC to ETH among crypto-native hedge funds and family offices. This shift in investment strategy is further supported by the recent net inflows into U.S.-listed spot ETH ETFs, with BlackRock’s ETHA product receiving a significant allocation from institutional investors.

Looking ahead, there is potential for further gains for ether against bitcoin, as the ETH/BTC ratio has shown signs of a trend reversal. Crypto trader Pentoshi believes that a short-term reversal is likely for ether, indicating that the recent surge in ETH’s performance may continue in the coming days.

On the other hand, bitcoin seems to have hit a roadblock at the $100,000 level, with a significant sell wall preventing further upside movement. Paul Howard from Wincent suggests that bitcoin may trade sideways for a while as investors assess the recent rally. He advises staying market-neutral and considering downside protection in the current market environment.

Overall, the recent performance of ether against bitcoin reflects a broader trend in the cryptocurrency market, where investors are exploring alternative assets beyond the traditional market leader. As the crypto landscape continues to evolve, it will be interesting to see how this rotation of capital impacts the overall market dynamics in the coming weeks and months.