The odds of Democratic candidate Kamala Harris winning the upcoming U.S. presidential election have been increasing on the Polymarket betting platform. This increase, from 33% on Oct. 30 to nearly 39%, could be attributed to traders hedging their bets. Traders are making strategic moves to protect against a potential loss if Donald Trump were to win the election.

There have been reports of voting irregularities against Trump, which may be influencing the market bets. Trump’s odds have dropped to 61%, indicating lower expectations of him winning. However, he is still the preferred candidate, despite the decrease in his odds. The recent slide in the crypto market has been linked to Trump’s slump on Polymarket, with the CoinDesk 20 Index dropping 4.4% in the past 24 hours.

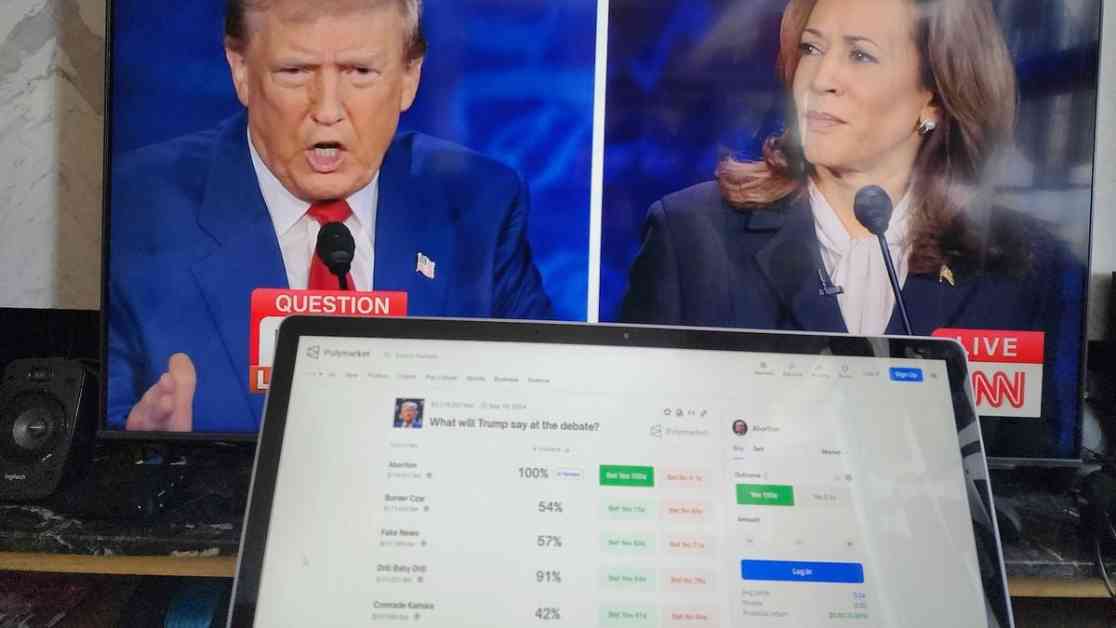

Polymarket operates as a betting marketplace where users can purchase “shares” in the outcome of various predictions. The odds are dynamic and change with each trade, reflecting the sentiment of the market participants. The platform works on a blockchain-based order book, similar to traditional asset exchanges.

The increase in the price of Harris’ shares could be a result of traders buying them as a hedge against their Trump bets. This strategy allows traders to mitigate their risk and potentially earn higher returns. Large trades of over $10,000 have been observed in the past 12 hours, with significant amounts of Harris “yes” shares and Trump “no” shares being purchased.

Some users have pointed out arbitrage opportunities for traders participating in election-based markets. By accessing both Robinhood Securities and Polymarket, traders can take advantage of price differences and potentially profit from the outcome of the election. As allegations of election fraud in key states continue to surface, the market remains volatile and unpredictable.

The evolving situation in the U.S. presidential election has led to increased activity on prediction markets like Polymarket. Traders are closely monitoring the odds and adjusting their positions accordingly. The outcome of the election will have significant implications for the financial markets and the broader economy. As the election day approaches, all eyes will be on the results and their impact on the political landscape.