A detailed look at OKX’s crisis management strategy reveals fascinating insights into how the exchange prepares for potential regulatory failures. The recent announcement of a $500 million settlement with the U.S. Department of Justice sheds light on OKX’s meticulous planning and response protocols in the face of regulatory challenges.

On Monday, OKX confirmed a settlement with U.S. authorities after allegedly facilitating $5 billion in suspicious transactions and failing to secure a money transmitter license. This settlement was not unexpected, as internal documents suggest that OKX had been preparing for such an outcome for some time. The exchange’s crisis management document outlines a strategic approach to handling regulatory scrutiny, emphasizing transparency, cooperation, and communication with stakeholders.

Behind the Scenes: OKX’s Crisis Response Plan

The secret crisis management document seen by CoinDesk reveals a well-orchestrated response plan that includes a messaging “SWAT Team” to manage communications in the event of a settlement. The document outlines specific guidelines for OKX’s top executives, including founder Star Xu and President Hong Fang, on how to navigate social media and press interactions during times of crisis.

One key aspect of the plan is to acknowledge the broader regulatory landscape in the cryptocurrency industry and position OKX as a cooperative entity working in alignment with regulators. By emphasizing collaboration and compliance, OKX aims to build trust and credibility with authorities and the public alike. This approach was evident in Monday’s press release, which highlighted the exchange’s appreciation for the DOJ’s collaboration.

Lessons Learned: The OKB Conundrum

The planning document also addresses concerns related to OKX’s native cryptocurrency, OKB, in light of previous market incidents. While OKB has not faced the same challenges as other exchange tokens, such as FTX’s FTT token, OKX remains vigilant about potential vulnerabilities. The exchange took swift action following a flash crash in January 2024, compensating users affected by the incident.

In response to the OKB crash, OKX made organizational changes, parting ways with executives Tim Byun and Wei Lan. Byun’s departure, in particular, underscored the exchange’s commitment to accountability and risk management. The protocol advises executives to avoid discussing OKB unless directly asked, emphasizing transparency and prudent communication.

Navigating the Media Landscape: OKX’s PR Strategy

Media management is a crucial component of OKX’s crisis response plan, with a focus on proactive engagement and strategic communication. In the event of media inquiries, the exchange mobilizes its SWAT Team and PR team to coordinate responses and shape the narrative. By reaching out to key publications and crafting a parallel story to complement the original coverage, OKX aims to control the conversation and mitigate reputational risks.

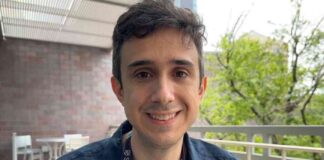

As a seasoned journalist, Ian Allison brings a wealth of experience and insight to the evolving landscape of cryptocurrency regulation and enforcement. His coverage of OKX’s compliance challenges underscores the complexities facing digital asset exchanges in today’s regulatory environment. With a keen eye for detail and a commitment to investigative reporting, Allison sheds light on the inner workings of OKX’s crisis management strategy and its implications for the broader crypto industry.

Ian Allison’s comprehensive reporting on institutional adoption of cryptocurrency and blockchain technology has earned him prestigious awards and accolades, highlighting his dedication to excellence in financial journalism. By delving into the nuances of OKX’s compliance failure settlement, Allison provides readers with a nuanced perspective on the challenges and opportunities facing digital asset exchanges in an increasingly regulated marketplace.

As the crypto industry continues to navigate regulatory uncertainties and compliance challenges, OKX’s experience serves as a cautionary tale for exchanges seeking to maintain trust, transparency, and integrity in a rapidly evolving landscape. By dissecting the exchange’s crisis management strategy, journalists like Ian Allison shed light on the intricate dynamics between regulators, exchanges, and market participants, offering readers a deeper understanding of the forces shaping the future of digital finance.

Ian Allison is a seasoned reporter with a passion for uncovering the truth behind complex financial stories. His dedication to investigative journalism and insightful analysis sets him apart as a leading voice in the world of cryptocurrency reporting. With a keen eye for detail and a commitment to ethical reporting, Allison’s work serves as a valuable resource for readers seeking to understand the intricacies of the digital asset ecosystem and the challenges facing industry participants in an era of heightened regulatory scrutiny.