Bitcoin {BTC} hit a new all-time high above $110,000 on Thursday, causing around $500 million worth of derivatives positions to be liquidated. However, despite this bullish move, some traders remain skeptical. Trading volume surged by 74% in the past 24 hours as traders tried to position themselves, but the majority of them chose to go short, betting on bitcoin’s price dropping.

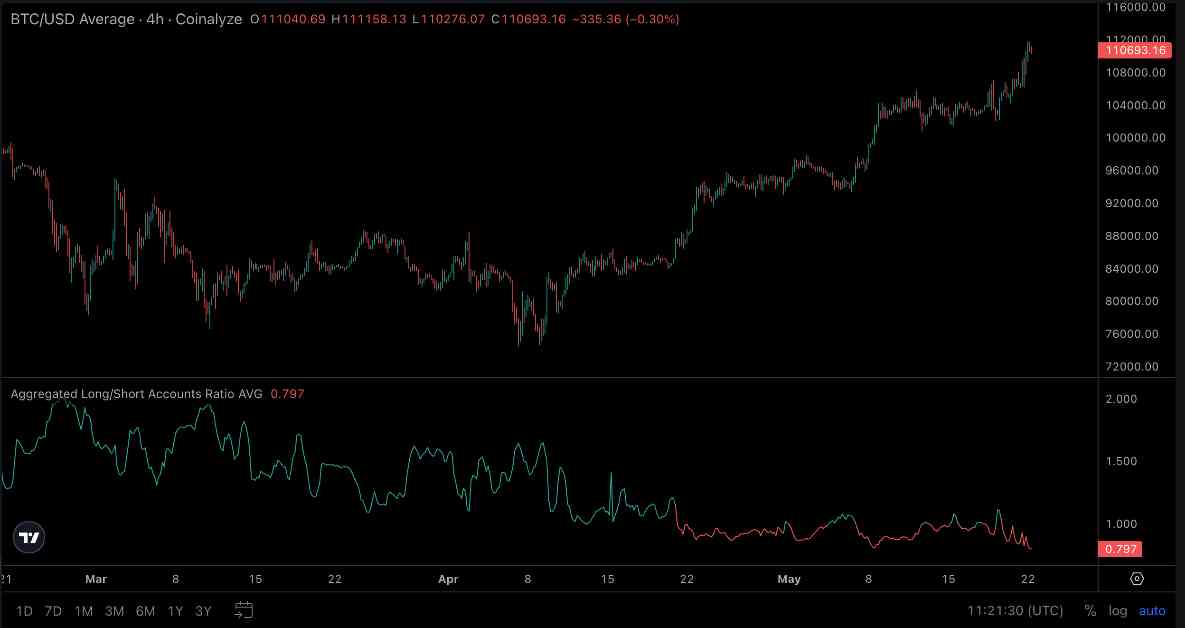

The long/short ratio is currently at its lowest point since September 2022, during the crypto winter. This trend started on April 21 when traders aggressively shorted the breakout above $85,000, believing that bitcoin had already reached its peak for the cycle. Despite the lack of retail participation, bitcoin continued to climb higher, breaking through resistance levels at $97,000 and $105,000 along the way.

Several factors contributed to this upward move, including a recovery in U.S. equities, increased institutional activity on exchanges like the CME, and a significant number of short positions that needed to be squeezed to push prices higher. While short positions may seem bearish, they actually provide opportunities for bullish traders to target areas and trigger stop-loss hunts.

Shorting an asset at its record high can be a viable strategy, allowing traders to enter short positions at key resistance levels and set stop losses to protect their profits. Despite the rise in short positions, open interest in bitcoin has also increased disproportionately, indicating that leverage is driving the current rally. It remains to be seen whether interest in short positions will continue to grow as bitcoin surpasses $111,000, but there are plenty of short positions waiting to be squeezed if needed.