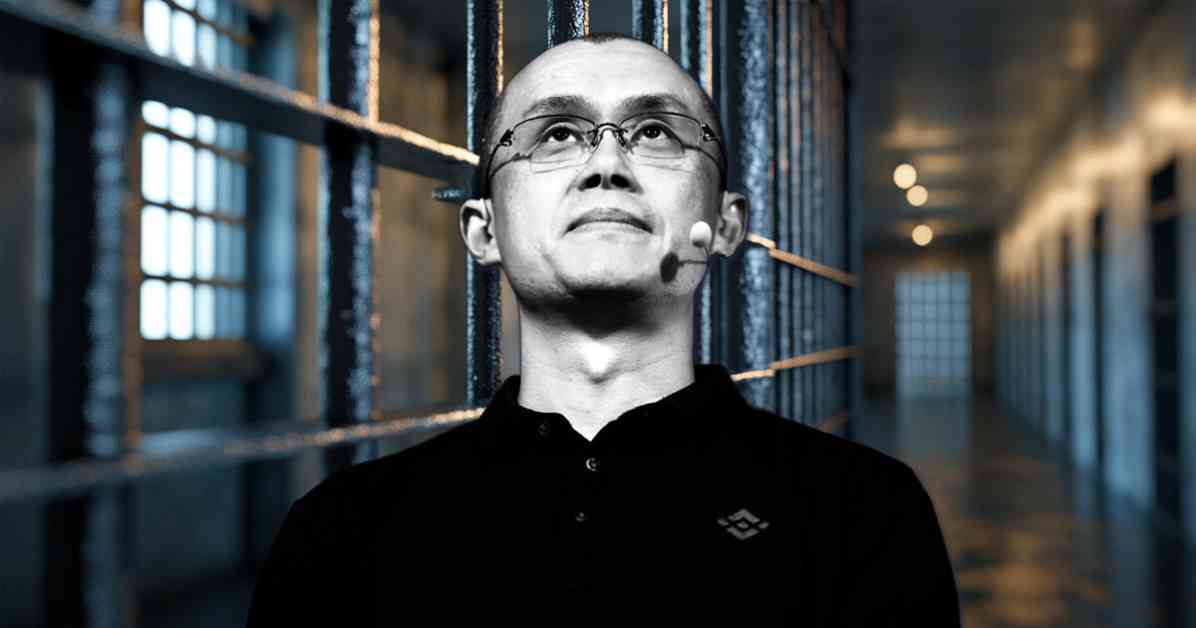

Binance co-founder Changpeng Zhao is set to be released from US custody on September 29, according to the US Federal Bureau of Prisons website. Zhao, who is currently serving a four-month sentence, was recently transferred to the Long Beach Residential Reentry Management (RRM) facility in central California. RRMs serve as local federal prison liaisons, assisting inmates nearing release by working with federal courts, the US Marshals Service, and local corrections.

Legal Issues:

Zhao’s legal issues began in November when he and Binance pleaded guilty to breaking US federal laws. The allegations included Zhao’s failure to implement an effective anti-money laundering program, as required by the Bank Secrecy Act. It was also alleged that Binance had processed transactions linked to unlawful activities, including those between US citizens and individuals in sanctioned regions like Iran. As part of the settlement, Binance was ordered to pay $4.3 billion in fines, while Zhao personally agreed to pay $50 million. Zhao also stepped down as Binance’s CEO but retains an estimated 90% ownership in the company.

Binance’s Legal Struggles:

While Zhao’s legal troubles are nearing an end, Binance’s legal issues continue. The US Securities and Exchange Commission (SEC) recently filed an amended complaint against the exchange, reiterating its accusation that the exchange violated federal securities law. The SEC claimed that Binance plays a key role in the crypto market by republishing and amplifying information from issuers and promoters. The filing also alleged that Binance promotes digital assets it lists and trades by sharing details on asset development, trading volumes, and price information. Furthermore, the financial regulator reaffirmed its stance that Binance’s token, BNB, was offered and sold as a security. It also highlighted the expectation among customers, employees, and investors that BNB would increase in value due to efforts by issuers and promoters. This comes despite a previous court decision dismissing charges related to the secondary sale of BNB by third parties.

Release from Custody:

Zhao’s impending release from US custody on September 29 comes at a crucial time as Binance faces ongoing legal battles with the SEC. Despite his personal legal troubles, Zhao’s release could potentially impact the future direction of Binance and its operations in the United States. As one of the co-founders and major stakeholders in the company, Zhao’s involvement and decisions hold significant weight within the organization.

Impact on Binance:

The legal challenges faced by Binance have had a significant impact on the company’s reputation and operations. The allegations of violating federal laws and failing to implement adequate anti-money laundering measures have raised concerns among regulators and investors alike. The hefty fines imposed on Binance and Zhao serve as a stark reminder of the consequences of non-compliance in the crypto industry. As one of the largest cryptocurrency exchanges in the world, Binance’s legal struggles have broader implications for the entire digital asset market.

Future Prospects:

With Zhao set to be released from US custody, the future prospects of Binance remain uncertain. The amended complaint filed by the SEC adds another layer of complexity to the ongoing legal saga. The accusations of securities law violations and the promotion of digital assets without proper disclosure raise questions about Binance’s compliance with regulatory requirements. As the cryptocurrency landscape continues to evolve, the outcome of Binance’s legal battles could have far-reaching implications for the industry as a whole.

In conclusion, Changpeng Zhao’s impending release from US custody on September 29 marks a significant development in the ongoing legal saga surrounding Binance. As the co-founder and former CEO of the company, Zhao’s personal and professional decisions have been closely scrutinized in the wake of the legal challenges faced by Binance. The amended complaint filed by the SEC adds another layer of complexity to the situation, raising questions about the exchange’s compliance with federal securities law. As Binance navigates these legal hurdles, the future direction of the company and its operations in the United States remains uncertain.