Hawk Tuah Girl Denies Selling Tokens: Memecoin Launch Receives Backlash

In a stunning turn of events, viral internet personality Haliey Welch, also known as the Hawk Tuah Girl, has found herself at the center of a crypto controversy after the launch of her memecoin HAWK on the Solana blockchain. The token’s meteoric rise and subsequent crash have sparked outrage among investors and drawn sharp criticism from the crypto community.

HAWK Memecoin: A Rollercoaster Ride

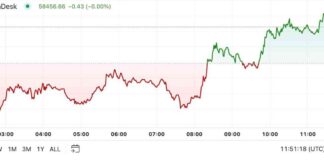

On December 4, the HAWK memecoin made its debut on the Solana blockchain to much fanfare. Within minutes, the token’s market cap skyrocketed to an impressive $500 million, only to plummet to a mere $60 million shortly after. This dramatic fluctuation left many investors reeling and raised suspicions of potential market manipulation.

Insider Trading Allegations and Regulatory Scrutiny

Blockchain analysis conducted by Bubblemaps revealed troubling details about the HAWK token’s launch. According to the firm, a staggering 96% of the token’s supply was allegedly controlled by insider wallets, a red flag for potential market manipulation. These findings have fueled skepticism about the legitimacy of the project and prompted accusations of unethical practices.

During an X Spaces event hosted by the project’s team, on-chain investigator Coffeezilla publicly criticized Welch and her team for their alleged involvement in insider trading. He accused them of profiting at the expense of their fans, further tarnishing the project’s reputation and credibility.

Legal Fallout and Community Backlash

The token’s collapse has not only incited outrage on social media but has also led to reports being filed with regulatory authorities. Some investors have taken their complaints to the US Securities and Exchange Commission (SEC), while law firms like Burwick Law have offered legal assistance to those who suffered losses. Additionally, members of the crypto community have created a satirical token called “Straight Tuah Prison,” suggesting that Welch should be held accountable for the project’s failure.

In response to the mounting criticism, Welch took to X to defend herself and her team, denying any wrongdoing and asserting that they did not sell any tokens or provide free allocations to influential figures. Despite her reassurances, the controversy surrounding the HAWK token raises important questions about the risks associated with celebrity-endorsed crypto projects and the need for greater transparency in the industry.