Bitcoin, the largest cryptocurrency by market capitalization, has been experiencing a period of consolidation around the $58,000 mark as the broader digital asset market shows signs of stability. In this article, we will delve into the recent price movements of Bitcoin, the potential impact of September on the cryptocurrency market, and the shifting odds in the upcoming U.S. presidential election.

Bitcoin Price Analysis

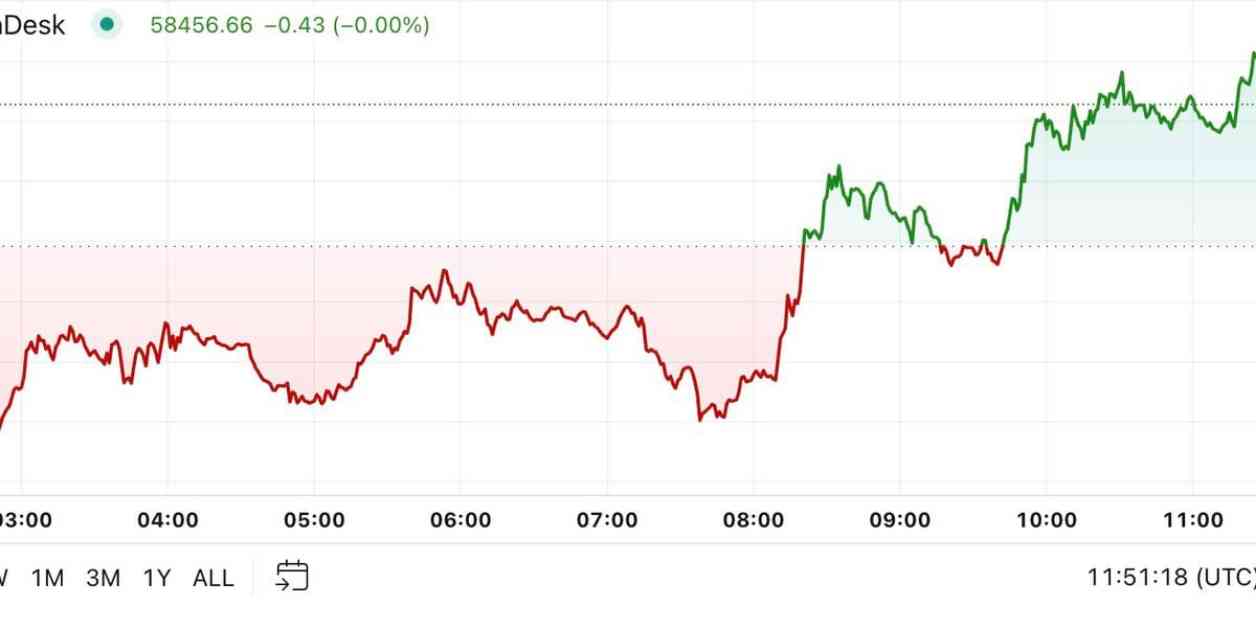

As of the time of writing, Bitcoin is trading at around $58,600, representing a 1% increase in the past 24 hours. Despite some fluctuations, Bitcoin has managed to hold steady around the $58,000 level, indicating a certain level of resilience in the face of market uncertainty. The broader digital asset market has also seen a slight uptick, with Ethereum (ETH) and Solana (SOL) gaining around 1.9% and 0.5%, respectively.

Some traders have pointed out that September is historically a bearish month for Bitcoin, with an average value depletion rate of 6.56%. However, there is optimism that a potential interest rate cut by the Federal Reserve could reverse this trend. Innokenty Isers, founder of crypto exchange Paybis, noted that rate cuts typically lead to excessive US dollar flow in the economy, which could bolster Bitcoin’s status as a store of value.

Impact of Interest Rate Cut on Bitcoin

The Federal Reserve’s decision to cut interest rates could have a significant impact on Bitcoin and the broader cryptocurrency market. Historically, rate cuts have been associated with increased investor interest in alternative assets like Bitcoin, as they seek to hedge against inflation and economic uncertainty. If the Fed decides to lower interest rates in September, it could provide a much-needed boost to Bitcoin and help it break free from the bearish trend typically seen during this month.

U.S. Election Odds and Bitcoin

In addition to market dynamics, the upcoming U.S. presidential election is also shaping investor sentiment towards Bitcoin. Traders on platforms like Polymarket are closely monitoring the odds of candidates like Republican Donald Trump and Democrat Kamala Harris. Despite Harris’ earlier popularity, Trump’s odds have been steadily climbing, with traders placing bets worth millions of dollars on his victory.

Harris’ odds have dipped in recent weeks, partly due to concerns over her proposal to tax unrealized gains for individuals worth over $100 million. This policy has sparked backlash among traders and could impact her chances in the election. On the other hand, Trump’s odds have risen as he promotes a decentralized finance project that promises high yields for crypto users. This development has garnered attention from investors looking for alternative investment opportunities in the crypto space.

Bitcoin Miners’ Revenue and Market Challenges

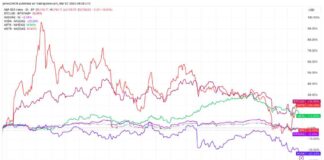

A recent chart shows that Bitcoin miners’ revenue declined in August to its lowest level since September 2023. This decrease was accompanied by an uptick in Bitcoin mining difficulty and a reduction in the number of BTC mined, highlighting the challenges faced by miners in the post-halving world. As the mining landscape becomes more competitive and resource-intensive, miners must adapt to these changes to remain profitable and sustainable in the long run.

In conclusion, Bitcoin’s price movements, market dynamics, and external factors like the U.S. election all play a role in shaping the cryptocurrency market’s trajectory. While September may historically be a bearish month for Bitcoin, there are opportunities for growth and resilience, especially in light of potential interest rate cuts and evolving market trends. Investors and traders alike should stay informed and adapt to changing conditions to navigate the volatile yet promising world of cryptocurrencies.