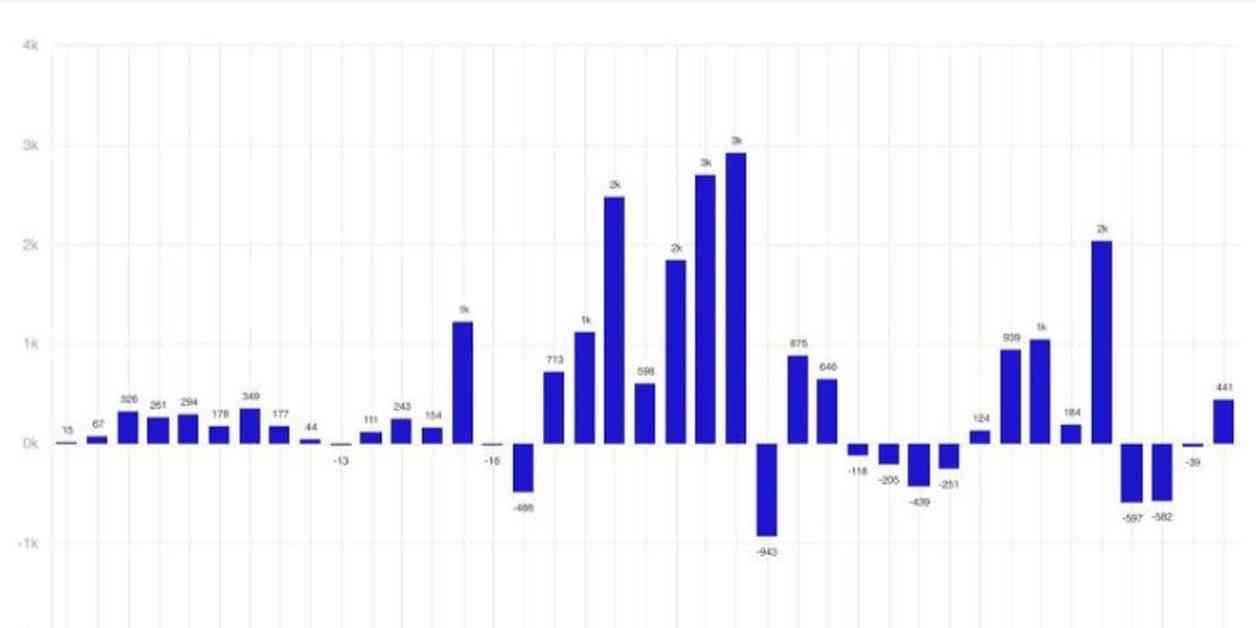

Digital asset investment products saw a positive turn last week after four consecutive weeks of net outflows, according to analysis by CoinShares. The total net inflows amounted to $441 million, with Bitcoin leading the way by accounting for $398 million of that total. CoinShares pointed out that it is uncommon for Bitcoin to represent only 90% of the total inflows, indicating a potential shift in investor behavior.

In addition to Bitcoin, Solana also stood out among altcoins, with SOL-linked products registering $16 million in inflows. CoinShares attributed this surge in investments to recent price weakness in the market, which was triggered by events such as the planned repayments by the defunct crypto exchange Mt. Gox to its creditors and the German government’s law-enforcement agency moving significant amounts of Bitcoin to exchanges. Investors saw these developments as a buying opportunity, according to CoinShares.

However, the positive sentiment towards digital assets was not reflected in blockchain equities, which saw $8 million in outflows last week. This brought their year-to-date total to $556 million in outflows, indicating a divergence in investor preferences between digital assets and blockchain equities.

The overall market dynamics suggest that investors are still actively engaging with digital assets, especially Bitcoin, despite the recent price fluctuations. The increasing interest in altcoins like Solana also indicates a growing diversification in investment portfolios within the digital asset space.

It is important to note that CoinDesk, the source of this analysis, is a reputable media outlet that covers the cryptocurrency industry. With a strict set of editorial policies in place, CoinDesk ensures transparency and accuracy in its reporting. In November 2023, CoinDesk was acquired by the Bullish group, which owns a regulated digital assets exchange. This acquisition has not compromised CoinDesk’s editorial independence, as it continues to operate as an independent subsidiary with an editorial committee safeguarding journalistic integrity.

Overall, the recent positive trend in net inflows to digital asset investment products, particularly in Bitcoin and Solana, reflects the resilience and attractiveness of the digital asset market to investors. Despite challenges in the broader financial landscape, digital assets continue to garner attention and investment interest from a diverse range of market participants.