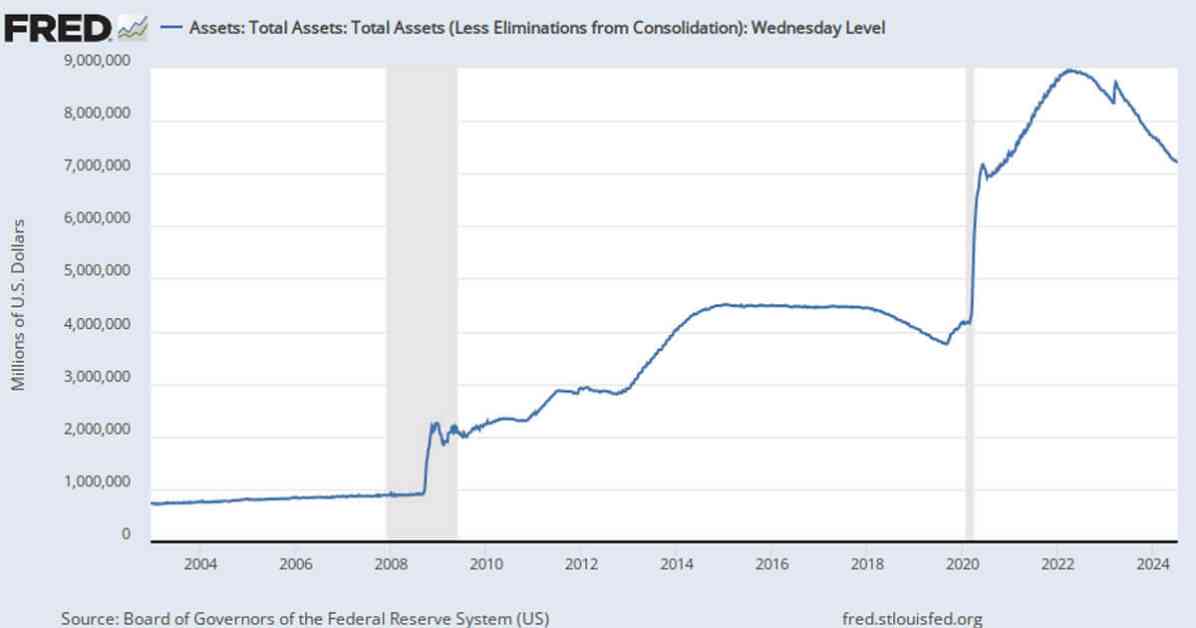

The Federal Reserve’s balance sheet has seen an increase of $2.6 billion, bringing it to $7.2 trillion. This rise comes amidst speculation about a potential rate cut as inflation cools. Despite the Fed’s efforts to tighten its quantitative policies, there have been periods of stagnation or growth in the balance sheet, with an overall downward trend over the past two years from a peak of $9.0 trillion.

Before the pandemic, the balance sheet was at $4.2 trillion, showing a significant increase of over 50% since then. The looming end of the rate-hiking cycle has led to growing speculation about the Fed’s first rate cut. This speculation has been fueled by the recent Consumer Price Index (CPI) inflation report, which showed a month-over-month deflationary rate of -0.1% on July 11. This decline in CPI inflation indicates a cooling economy, which may push the Fed towards considering a rate cut.

Both the balance sheet trends and inflation rates will play a crucial role in shaping the Federal Reserve’s monetary policy decisions in the near future. Investors and economists will be closely watching these indicators to gauge the Fed’s stance on interest rates and the overall economic outlook.

In addition to the balance sheet and inflation data, other factors such as employment numbers, GDP growth, and global economic conditions will also influence the Fed’s decision-making process. The central bank’s goal is to maintain stable prices and maximum employment while supporting long-term economic growth.

As the Fed navigates these uncertain economic waters, it will be important for investors to stay informed and monitor key indicators for any signals about future monetary policy actions. With the potential for a rate cut on the horizon, market volatility and investor sentiment may be impacted, making it essential to stay updated on the latest developments in the financial world.