Bitcoin Halving Impact on Volatility Trends: A Closer Look

The world of cryptocurrency is constantly evolving, with new trends and developments shaping the market every day. One such trend that has been grabbing headlines recently is the impact of Bitcoin halving on volatility trends. In this article, we will take a closer look at how the Bitcoin halving event has influenced the volatility of the leading cryptocurrency and what it means for traders and investors.

Implied Volatility: A Key Indicator

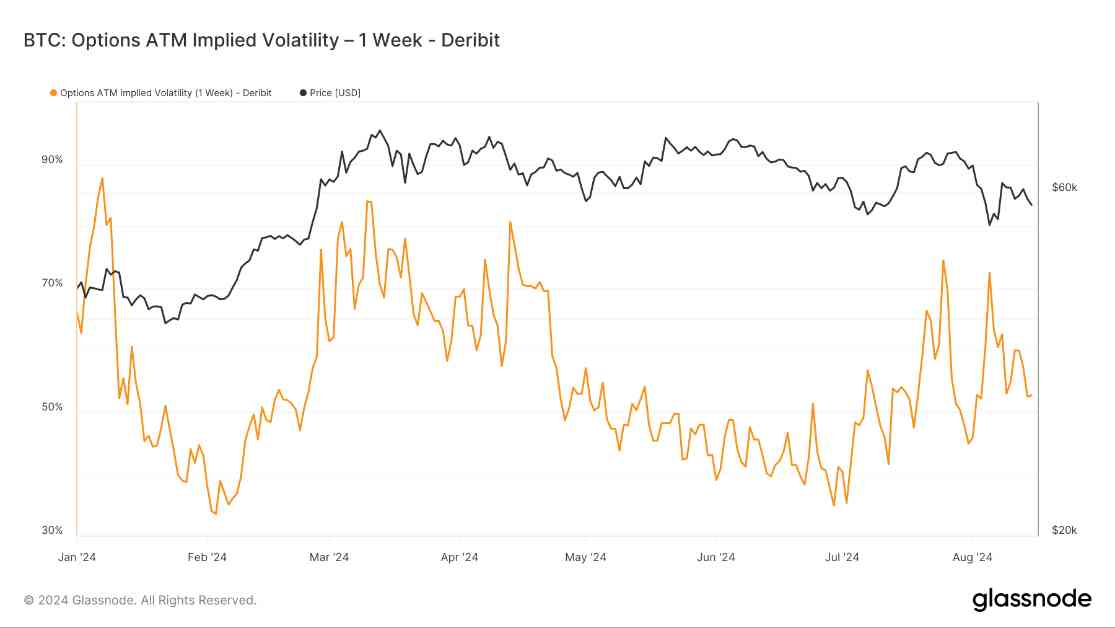

Implied Volatility (IV) is a crucial metric in the world of options trading, providing insights into market sentiment and expectations of future price movements. By analyzing the implied volatility of Bitcoin options contracts expiring in one week, we can gain valuable insights into the overall market sentiment towards the cryptocurrency.

Throughout 2024, Bitcoin’s 1-week implied volatility has experienced significant fluctuations, reflecting the uncertainty and speculation surrounding the digital asset. In the early part of the year, IV remained relatively stable at around 50%, with occasional spikes in January and February. However, as the halving event approached in April, volatility surged, peaking above 80% as traders anticipated potential market turbulence.

Post-halving, volatility initially declined but resurfaced in mid-year, driven by increased uncertainty in the market. Factors such as regulatory developments and macroeconomic conditions have contributed to the heightened volatility, creating a more speculative trading environment for Bitcoin.

Comparing 2024 to the previous year, it is evident that volatility levels have been higher, indicating that traders are increasingly factoring in short-term market risks. This trend underscores the evolving nature of the cryptocurrency market post-halving, with traders navigating through a changing regulatory landscape and global economic shifts.

The Impact of Halving on Volatility

The Bitcoin halving event, which occurs approximately every four years, is a key factor influencing market dynamics and volatility trends. During the halving, the reward for mining new Bitcoin blocks is reduced by half, leading to a decrease in the supply of new coins entering the market. This scarcity effect has historically been associated with increased price volatility as traders adjust to the new supply-demand dynamics.

In the lead-up to the halving, traders often engage in speculative trading, anticipating potential price movements and market trends. This heightened activity can lead to increased volatility as market participants react to news and events surrounding the halving event. The surge in volatility post-halving reflects this speculative trading behavior, as traders adjust their strategies in response to changing market conditions.

Regulatory Developments and Market Uncertainty

Apart from the halving event, regulatory developments and market uncertainty have also played a significant role in driving volatility in the cryptocurrency market. As governments around the world introduce new regulations and policies related to cryptocurrencies, traders and investors are forced to adapt to changing market conditions.

The uncertainty surrounding regulatory developments can lead to increased volatility as traders assess the potential impact of new regulations on the market. Additionally, macroeconomic factors such as inflation, interest rates, and geopolitical events can also influence the price of Bitcoin, contributing to market uncertainty and volatility.

Traders and investors must stay informed about regulatory changes and market developments to navigate the volatile cryptocurrency market effectively. By understanding the factors driving volatility and market trends, traders can make informed decisions and mitigate risks in an ever-changing market environment.

Looking Ahead: Future Trends and Challenges

As we look ahead to the future of the cryptocurrency market, it is clear that volatility will continue to be a defining characteristic of Bitcoin and other digital assets. Traders and investors must be prepared to navigate through the ups and downs of the market, adapting their strategies to changing conditions and market trends.

The evolving regulatory landscape and global economic shifts will continue to influence the price of Bitcoin, creating challenges and opportunities for market participants. By staying informed and analyzing market data and trends, traders can position themselves for success in the dynamic world of cryptocurrency trading.

In Conclusion

The Bitcoin halving event has a significant impact on volatility trends in the cryptocurrency market, reflecting the speculative trading behavior of market participants. By analyzing implied volatility and market sentiment, traders can gain valuable insights into the evolving market dynamics and make informed decisions to navigate through the volatile cryptocurrency market effectively.

As we look ahead to the future, it is essential for traders and investors to stay informed about regulatory developments, market trends, and macroeconomic factors that influence the price of Bitcoin. By understanding the factors driving volatility and market uncertainty, traders can adapt their strategies and mitigate risks in an ever-changing market environment.