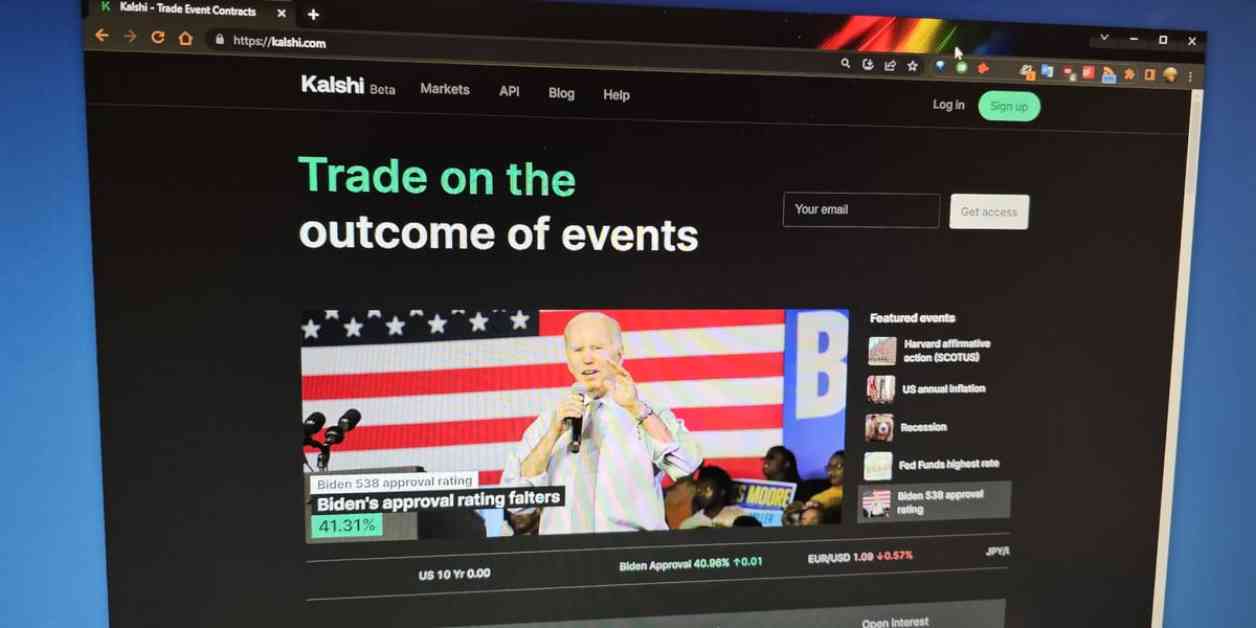

Kalshi’s Political Prediction Markets on Hold Amid CFTC Appeal

A U.S. federal appeals court has put a temporary halt on Kalshi’s brand-new political prediction markets, following a request for an emergency stay from the Commodity Futures Trading Commission (CFTC). This move comes after the regulator lost a similar motion to a lower-level judge.

Kalshi, a plaintiff in the case, had been in a legal battle with the CFTC over the agency’s decision to ban the listing of U.S. political prediction markets. These markets essentially involve betting on which party might control the House of Representatives or win the White House in any given term. Judge Jia Cobb of the District of Columbia court ruled last week that the CFTC had overstepped its authority by imposing this ban, siding with Kalshi in the dispute.

The CFTC had initially requested Judge Cobb to prevent Kalshi from listing any contracts while awaiting her full opinion on the matter. However, the judge denied this request, allowing Kalshi to proceed with listing its first U.S. political prediction markets. The CFTC, in response, filed an emergency motion to stay the markets to the appeals court as it considers whether to appeal the full ruling.

As of 11:30 p.m. ET on Thursday, trading on Kalshi’s two new contracts – asking which party will win the House and Senate – was paused, with a notice on Kalshi’s website citing a “pending court process.” The CFTC argued in its filing that Kalshi had rushed to launch these contracts before the agency had the chance to file a motion for a stay pending appeal.

Kalshi’s attorneys, on the other hand, contended that no administrative stay was necessary or appropriate. They maintained that the CFTC’s attempt to block the contracts was unfounded, as elections do not fall under the category of “gaming” or “unlawful activity” as outlined in the relevant statute.

The appeals court has now ordered Kalshi to halt its contracts while it reviews the motion, with a deadline for a response set for Friday evening. The CFTC will have the opportunity to file a reply by Saturday evening.

In the midst of this legal battle, the CFTC is also in the process of enacting a rule to ban political prediction markets in the U.S. overall, citing concerns about fraud in the underlying market, particularly in relation to elections. Judge Cobb acknowledged these concerns in her opinion but stated that they were not directly relevant to the case against Kalshi.

Kalshi’s decision to launch political prediction markets has sparked a debate about the intersection of gambling, finance, and politics. While some see these markets as a way to engage the public in the political process and potentially generate valuable data for researchers and analysts, others view them as a form of speculative gambling with the potential to influence election outcomes.

Despite the legal challenges it faces, Kalshi remains committed to providing a platform for individuals to participate in prediction markets. The company believes that these markets can serve as a valuable tool for predicting future events and outcomes, offering insights that traditional polling methods may not capture.

The outcome of the legal battle between Kalshi and the CFTC could have far-reaching implications for the future of political prediction markets in the U.S. Depending on how the appeals court rules, we may see a clearer regulatory framework emerge for these markets, shaping the way they are operated and monitored in the years to come.

Overall, the dispute between Kalshi and the CFTC highlights the complex and evolving nature of the intersection between finance, technology, and regulation in the digital age. As new platforms and technologies emerge to facilitate novel forms of trading and prediction, regulators will continue to grapple with how best to ensure market integrity and protect consumers while fostering innovation and competition in the financial sector.

The Future of Prediction Markets

As the legal battle between Kalshi and the CFTC unfolds, the future of prediction markets in the U.S. remains uncertain. While these markets have the potential to offer valuable insights into future events and outcomes, they also raise concerns about the potential for market manipulation and fraud.

One key question that regulators and policymakers will need to address is how to strike a balance between allowing innovation in prediction markets while safeguarding against potential risks to market integrity and consumer protection. This delicate balancing act will require close collaboration between industry stakeholders, regulators, and lawmakers to develop a regulatory framework that promotes transparency, fairness, and competition in prediction markets.

Impact on the Industry

The outcome of the legal battle between Kalshi and the CFTC could have a significant impact on the broader prediction market industry. If Kalshi is successful in its challenge against the CFTC’s ban, it could set a precedent for other platforms to offer similar markets in the future.

Conversely, if the CFTC’s ban is upheld, it could have a chilling effect on the development and growth of prediction markets in the U.S. This could stifle innovation in the industry and limit the ability of individuals to participate in these markets, potentially depriving researchers, analysts, and policymakers of valuable predictive data.

Ultimately, the resolution of this legal dispute will shape the future landscape of prediction markets in the U.S. and influence how these markets are regulated and operated in the years to come. As the industry continues to evolve and expand, it will be crucial for regulators, policymakers, and industry stakeholders to work together to ensure that prediction markets can thrive in a safe, transparent, and competitive environment.

In conclusion, the legal battle between Kalshi and the CFTC over political prediction markets underscores the challenges and opportunities that arise at the intersection of finance, technology, and regulation. As these markets continue to evolve and gain traction, it will be essential for regulators and industry stakeholders to collaborate and develop a regulatory framework that supports innovation while safeguarding against potential risks to market integrity and consumer protection.